Executive Summary

A Radical Transformation

This report analyzes Palladyne AI Corp. (NASDAQ: PDYN). The company has undergone a radical transformation, evolving from a pioneering robotics hardware developer into a pure-play artificial intelligence (AI) software firm.

Formerly known as Sarcos Technology and Robotics Corporation (STRC), the company was renowned for its “big robots.” These included the Guardian® XO powered exoskeleton and the Guardian® Sea Class underwater robot designed for tasks like ship hull cleaning.¹

In early 2024, the company executed a complete pivot. It ceased all hardware operations to focus exclusively on commercializing its advanced AI and machine learning (ML) software platform.² This strategic shift was marked by a name change and a new ticker symbol (PDYN), fundamentally redefining its business model and investment thesis.³

New Focus, New Revenue Model

Palladyne AI’s future revenue now depends entirely on two software products:⁴

- Palladyne™ IQ for industrial robots.

- Palladyne™ Pilot for drones and other unmanned systems.

The company has transitioned to a pre-revenue stage for these new products. Its business model is now based on software licensing fees.⁵

Key Financial Takeaways

A key financial takeaway is that the company’s reported net income of $15.3 million in the first half of 2025 is misleading. This figure stems from a $29.4 million non-cash, non-operating gain related to changes in the value of warrant liabilities.⁶ This accounting artifact masks the reality that the core business is operating at a loss.⁷

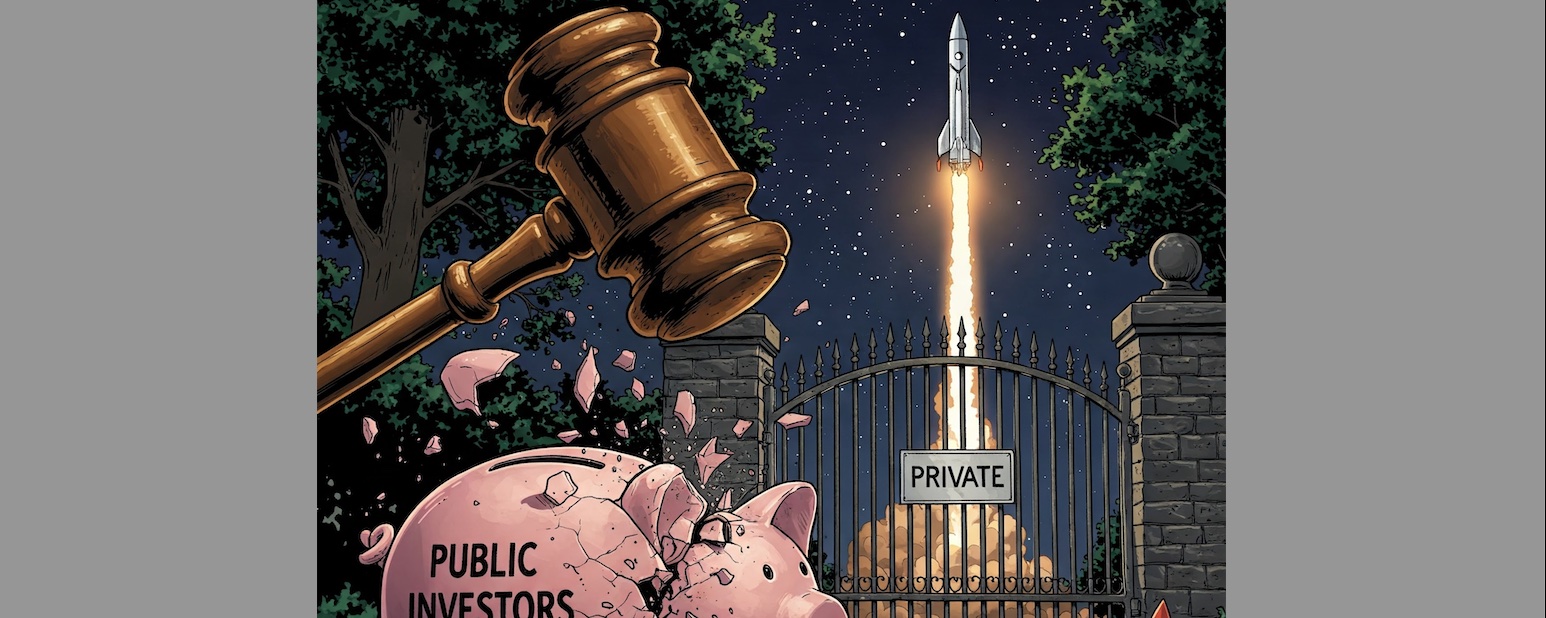

A High-Risk, High-Reward Proposition

This pivot has created a high-risk, high-reward proposition. Palladyne AI is essentially a 40-year-old startup. It leverages a deep history in robotics to compete as a nimble, high-margin software company.

Its success is contingent on its ability to execute its commercialization strategy. The company must achieve market adoption for its novel, hardware-agnostic AI platform. The platform’s goal is to provide the intelligence that makes all robots better, not just its own.

(more…)