I have a strong aversion to Peter Hegseth because he champions The UniParty’s Vision for America: A Globalist Project to Make America a Sharia-Compliant Infidel Exclusion Zone. This summer, while he was promoting “American drones,” I discovered through metadata on an X post that his team was using CCP-made DJI drones to “secure” our border with Mexico. One of the border patrol groups inadvertently posted it. When I confronted him with this evidence, he never responded. For this reason, I also call him “Peter ‘DJI’ Hegseth”—his hypocrisy is boundless.

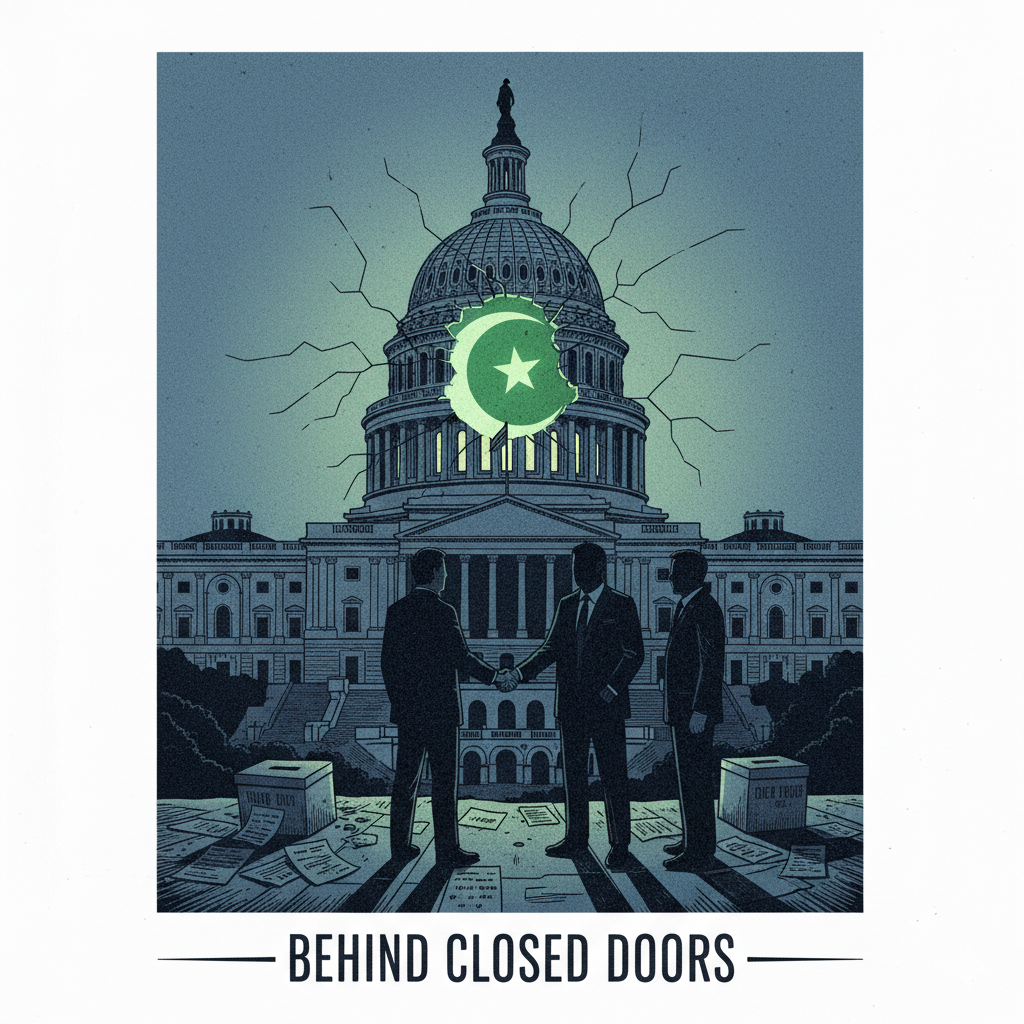

The establishment—the UniParty that wants me, an Infidel, dead—pushes this agenda. Search for “Sharia” or “Sharia-compliant” on the White House website, specifically in articles like this one praising deals secured by President Trump: https://www.whitehouse.gov/articles/2025/05/what-they-are-saying-trillions-in-great-deals-secured-for-america-thanks-to-president-trump/ (Archive: http://archive.is/72BVI).

There is a profound hypocrisy in our leadership. Figures like Obama, Trump, and Newsom laud what I consider a terrorist death cult that commands the killing of Infidels like myself, David Gross. Yet, they imprison patriots like Irwin Schiff (Peter Schiff’s father) for tax resistance. Why did Trump, a jab-pusher and Blackrock globalist, fly to meet with terrorist groups like Hamas during a government shutdown? He should stay over there if he supports the killing of infidels. He is our first full-blown Islamic Terrorist President, praised by sympathizers like Biden and Kamala. The UniParty has become synonymous with Al Qaeda.

I also believe a corrupt element within our government is complicit. A group within the New York Department of Environmental Conservation (DEC) had pre-knowledge of the “Kirk hit.” I reported this to the FBI both before and after the event, and they did nothing. I am convinced that figures like Kash Patel, Dan Bongino, and Pam Bondi are extremely corrupt. Their inaction allowed individuals like Mohammed Sabry Soliman to be missed in Denver because they needed to protect financial interests, such as Franklin Templeton’s Sharia-compliant deals. They have an agenda to import Islamic militants, just as Clinton allowed bin Laden to operate before 9/11.

This same pro-Hamas group in the New York DEC is actively trying to bring in more Islamic extremists. Both Mamdani and Trump are shielding terrorists and are, in my view, terrorist sympathizers. It’s no coincidence that Trump was a registered Democrat in New York City at the turn of the millennium; I believe he still owes dues to terrorists.

It is time to stop paying taxes, following the example of Irwin Schiff.

For those who love America, arm yourselves. This is for our country.