The landscape of American commerce is littered with the ghosts of giants that once seemed invincible. Names like Circuit City evoke a recent memory of sprawling stores that went from market leaders to liquidation sales with startling speed. While it’s easy to see the collapse in hindsight, the more pressing question is whether the warning signs were visible all along.

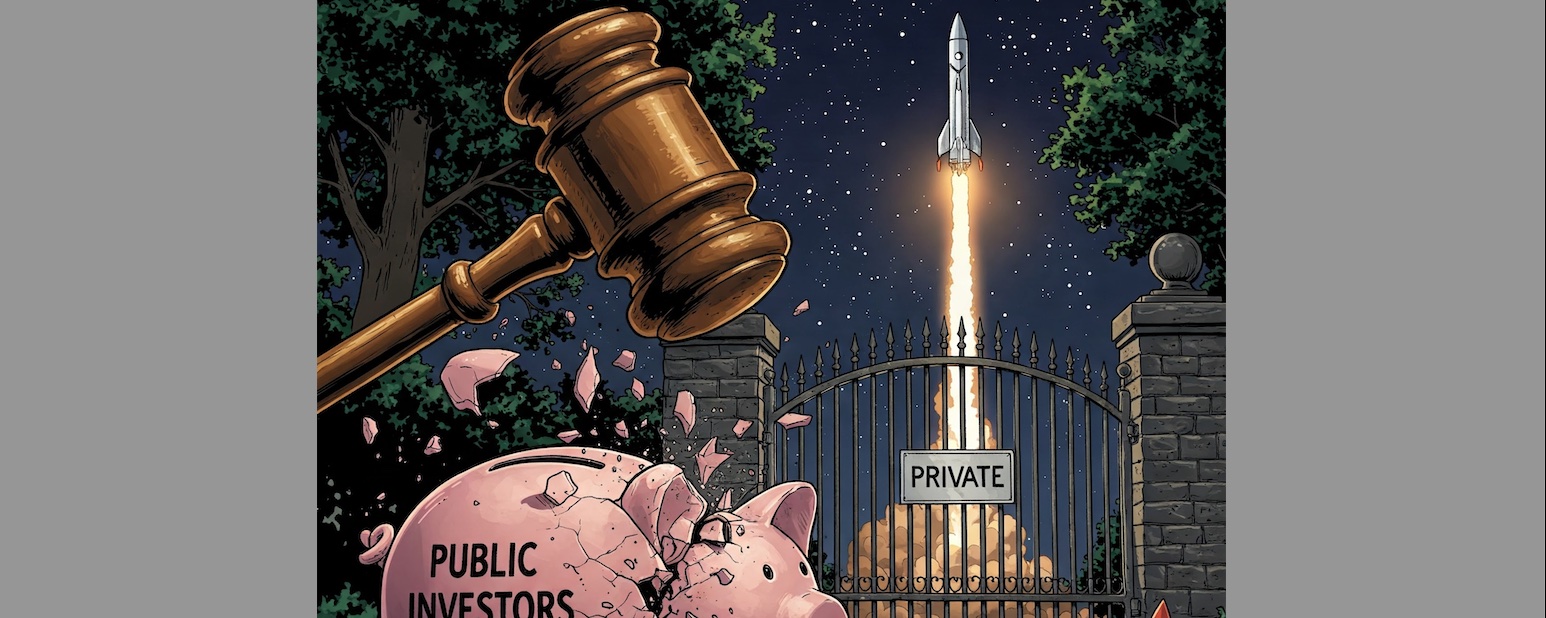

The answer is often a resounding yes, but the most potent signals of deep corporate trouble are rarely found in splashy headlines. Instead, they are hidden in a modern playbook for corporate decay: one that prioritizes aggressive financial engineering over operational health, enabled by respected legal structures and rewarded by profoundly misaligned executive incentives. This article uncovers five of these overlooked red flags—buried in SEC filings, academic research, and strategic blunders—that can signal a company is on a dangerously unsustainable path.

1. When a Company’s Value Dips Below Zero

One of the most alarming yet surprisingly common signals is Negative Shareholders’ Equity (NSE). In simple terms, this occurs when a company’s total liabilities—everything it owes—exceed its total assets, or everything it owns. It is a classic sign of severe financial distress, indicating that if the company liquidated all its assets to pay its debts, shareholders would be left with nothing.

While one might assume this condition is reserved for obscure, failing businesses, a surprising number of household names operate with negative shareholder equity. Recent financial analyses reveal this list includes retailers like Lowe’s, coffee behemoth Starbucks, tech giant HP Inc., and personal care brand Bath & Body Works. This trend is particularly acute in certain industries. The “Home Improvement Retail” sector, for instance, which includes giants like Lowe’s, carries a staggering average Debt-to-Equity ratio of 44.17, showcasing an industry-wide addiction to the kind of debt-fueled share buybacks that hollow out a company’s financial foundation.

(more…)