Many have spoken about the need for American leadership in technology and the potential of digital assets. Vice President Vance has a point about paying attention to what global competitors like China are doing in the crypto space. However, the current conversation around cryptocurrency for everyday infrastructure and investment is a distraction from its most strategic and vital use case: national security.

Instead of trying to fit this technology into a peacetime financial system, we should be harnessing its power for when we need it most. I propose we treat the infrastructure of cryptocurrency like a strategic military asset, to be deployed only in times of war, much like war bonds. This isn’t about the coins themselves, but about the underlying technology and ASICs – a decentralized, resilient network that can be activated by the military upon a formal declaration of war.

This approach addresses the national security risks of unregulated crypto, while giving the U.S. a powerful economic and strategic tool in a time of conflict. It’s not about stifling innovation; it’s about focusing that innovation where it can have the most decisive impact for our nation.

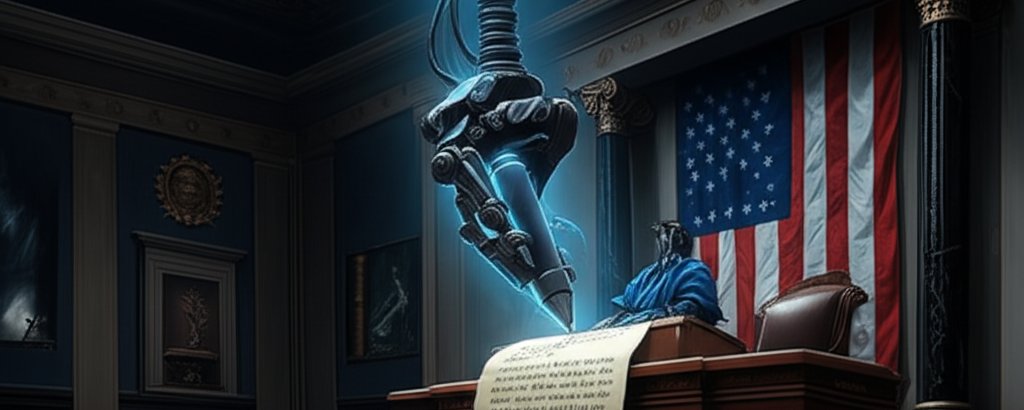

Proposed Legislation: The Wartime Digital Asset Act

A BILL

To restrict the use of cryptocurrencies and stablecoins to times of declared war, and for other purposes.

BE IT ENACTED BY THE SENATE AND HOUSE OF REPRESENTATIVES OF THE UNITED STATES OF AMERICA IN CONGRESS ASSEMBLED,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Wartime Digital Asset Act”.

(more…)