CEO Fired, $2.6 Billion Debt, and the Radical Pivot to Survival After the COVID Cash Crash

CEO Fired, $2.6 Billion Debt, and the Radical Pivot to Survival After the COVID Cash Crash

Executive Summary

The 2022 merger of Quidel Corporation and Ortho Clinical Diagnostics was designed to create a comprehensive diagnostics leader.¹ The strategy paired Quidel’s point-of-care agility with Ortho’s global laboratory strength.

However, the post-merger period proved challenging. The rapid decline of high-margin COVID-19 testing revenue exposed significant financial and integration difficulties. This situation culminated in a decisive course correction in early 2024. The board replaced the merger’s architect and installed a new C-suite with a clear mandate for change.²

QuidelOrtho is now in a fundamental turnaround. The company has pivoted from a strategy of “growth via merger” to one of “profitability via integration.” Under new leadership, the focus is intensely on operational efficiency, aggressive cost-saving, and prioritized debt reduction. The recent decision to discontinue the long-gestating Savanna® molecular platform in favor of acquiring a more promising external technology exemplifies this new, unsentimental approach.³

Significant risks remain, particularly the company’s substantial debt and recent negative cash flow.⁴ However, the path forward is now clearer. The new strategy is expected to restore profitability, strengthen the balance sheet, and drive long-term value through disciplined execution and focused innovation.

(more…)Unpacking the Dilution-Hype Cycle, Rebranded Drones, and Massive Contract Overstatements

Executive Summary

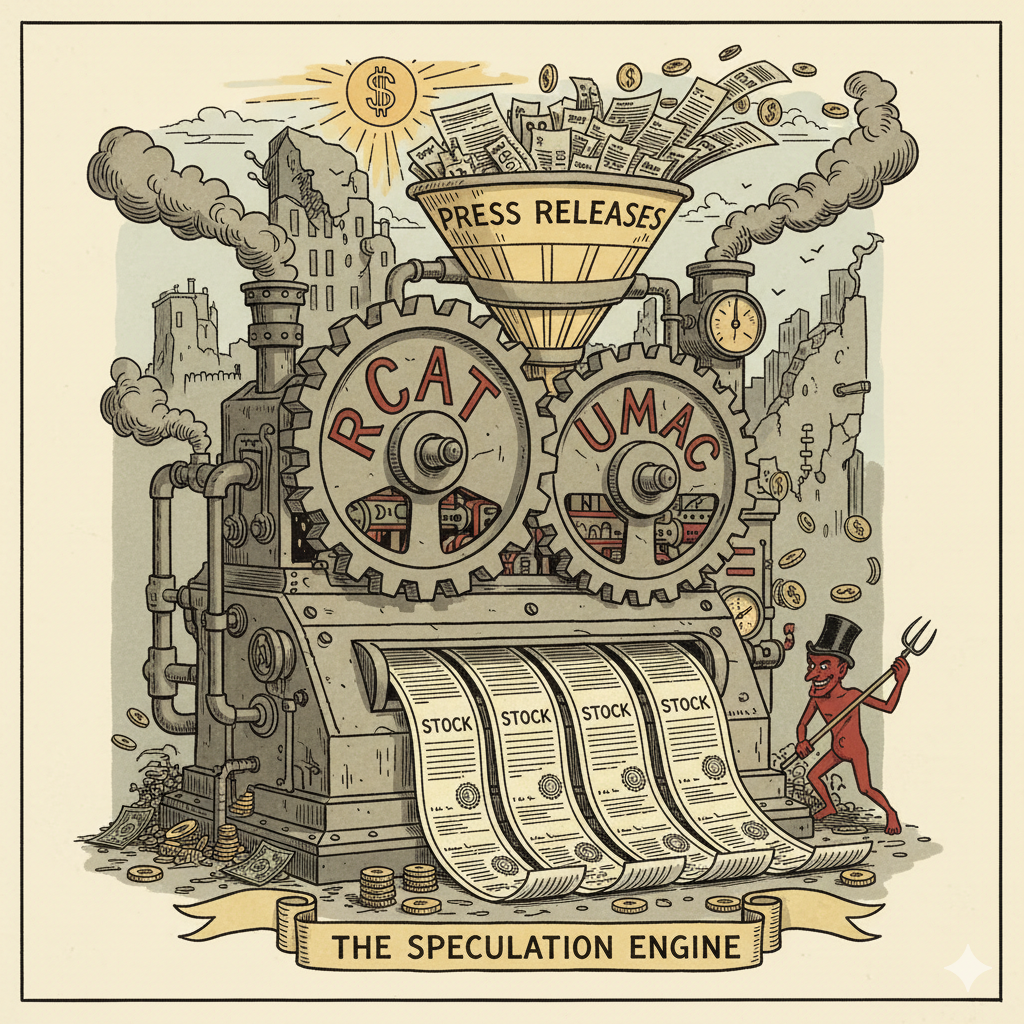

An in-depth investigation reveals a sophisticated and potentially fraudulent ‘Dilution-Hype Cycle.’ This cycle is at the core of Red Cat Holdings, Inc. (NASDAQ: RCAT) and Unusual Machines, Inc. (NYSE American: UMAC). The scheme appears strategically designed to perpetually extract capital from public markets.

This report details the interconnected corporate structure between the two companies. It analyzes the financial mechanics of their capital-raising activities and deconstructs their product and contract claims.

Our findings indicate the relationship between RCAT and UMAC is not a standard, arm’s-length corporate separation. It originated from RCAT’s divestiture of its consumer division. This move appears to be a strategic maneuver. It created a publicly-traded, controlled entity to facilitate a cycle of capital raising and stock promotion.

Key elements of this structure include:

Both companies are characterized by significant and persistent unprofitability. This makes them dependent on the capital markets for survival. They service this dependency through a continuous pattern of dilutive stock offerings, frequently managed by a common underwriter, ThinkEquity. This process appears to be the core business model.

Furthermore, third-party analysis has challenged the veracity of the companies’ product claims and contract values. Allegations suggest key products are rebranded consumer drones with Chinese-made components. The analysis also claims the value of a pivotal government contract has been significantly overstated, creating a potential revenue shortfall of approximately $57 million.¹

These activities, viewed in aggregate, bear the hallmarks of a coordinated stock promotion and financing scheme. The scheme utilizes related-party transactions and a circular corporate structure. The primary objective appears to be generating hype to facilitate the continuous sale of equity, a practice that may not serve the best interests of independent shareholders.

(more…)How Subscriptions, AI Data, and Extreme Cost-Cutting Saved? the Brand

On October 10, 2025, a single geopolitical announcement triggered the largest deleveraging event in the history of digital assets, exposing the fragile, overleveraged core of a euphoric market. This was not just a market crash; it was a Black Swan event that stress-tested the entire crypto ecosystem, revealing its deepest vulnerabilities and its surprising strengths.

The cryptocurrency market was shattered on Friday, October 10, 2025, by what appeared to be a singular geopolitical shock. In reality, it was the catastrophic failure of a market structure defined by extreme leverage and paradoxical sentiment. This historic deleveraging event, the largest in the history of digital assets, demonstrated the profound systemic risks that had built up beneath a surface of bullish euphoria.

President Donald Trump’s announcement of 100% tariffs on China was the undeniable catalyst. However, this report will show that the collapse resulted from a dangerous confluence of factors. The market was primed for volatility by a widely accepted “debasement trade” narrative, where a US government shutdown was ironically seen as a tailwind for asset prices. This perception led to all-time highs for Bitcoin and an unprecedented buildup of speculative, leveraged long positions.

The tariff announcement acted as a pinprick to this overleveraged bubble, triggering a violent liquidation cascade that erased between $9.5 billion and $19 billion from derivatives markets in 24 hours.¹³, ¹⁹ On-chain analysis reveals that the decentralized derivatives exchange Hyperliquid was the primary venue for this deleveraging.¹³ Furthermore, forensic evidence points to the strategic actions of sophisticated whale traders who not only anticipated the market’s vulnerability but also positioned themselves to profit immensely from the chaos.², ¹² This suggests the event was both a market-wide panic and a predatory hunt.

The analysis concludes with an assessment of the market’s structural health in the aftermath, identifying key indicators that will define its trajectory and offering a forward-looking perspective for navigating the new paradigm.

(more…)Executive Summary

Visa Inc. and Mastercard Incorporated form one of the global economy’s most powerful duopolies. While their brands are ubiquitous, the mechanics of their business models are often misunderstood. This report provides a comparative analysis of how these payment technology giants generate revenue.

At their core, both companies operate on an identical foundation. They use an “open-loop,” four-party model that connects consumers, merchants, issuing banks, and acquiring banks. They are not financial institutions. They do not issue credit or assume the risk of consumer default. Instead, they operate the vast technology platforms—VisaNet and the Mastercard Network—that serve as the digital rails for global commerce. They earn fees on immense transaction volumes. However, this shared foundation gives way to increasingly divergent strategic priorities.

The analysis reveals Visa’s clear dominance in scale. In fiscal year 2024, Visa processed $15.7 trillion in total volume across 233.8 billion transactions. This generated $35.9 billion in net revenue.¹ Its business model is deeply rooted in monetizing this scale through transaction-centric revenue streams: Data Processing, Service, and International Transaction fees.

Mastercard is smaller, with $9.8 trillion in gross dollar volume and 159.4 billion switched transactions in fiscal year 2024.²,³ It has strategically positioned itself as a more diversified technology partner. This is most evident in its financial reporting, which is structured around two distinct pillars: the core Payment Network and a rapidly expanding Value-Added Services and Solutions (VAS) segment. In 2024, the VAS segment generated $10.83 billion. This accounted for a remarkable 38.5% of Mastercard’s $28.2 billion in total net revenue and is growing much faster than its core payments business.²,⁴

This report concludes that the competitive dynamic between the two companies is evolving. The fundamental mechanism of earning fees on payment volume remains the bedrock for both. However, Visa’s strategy now focuses on leveraging its scale to expand its “network of networks” into new payment flows, like business-to-business payments. Mastercard, conversely, is executing a clear strategy of differentiation through services. It embeds itself more deeply with clients through offerings in cybersecurity, data analytics, and loyalty programs. The future of this duopoly will be defined less by processing payments and more by their ability to innovate and monetize the ecosystem of services surrounding the transaction.

(more…)