The analogy comparing the national debt to the COVID-19 “flatten the curve” mantra is a profoundly misleading and dangerous simplification of the crisis we face. The comparison is particularly flawed when one recalls the data inconsistencies during the initial wave of COVID-19. In early 2020, many observers noted with suspicion that official data from sources like Johns Hopkins University showed a startlingly low number of recoveries in the United States. This data “weirdness,” born from the chaos of tracking a novel virus in real-time, highlights a key difference: the COVID-19 curve was a matter of incomplete, real-time data, while the national debt curve is a matter of precise, cumulative accounting.

The national debt isn’t a virus that will simply “burn out” or be defeated by a short-term, emergency response. It is a chronic, metastasizing cancer on the body politic, the result of decades of policy decisions. Proposals for a “debt ceiling app” or other simple fixes are shortsighted political theater. Congress has repeatedly demonstrated its willingness to raise the debt ceiling, rendering it more of a talking point than a genuine constraint.

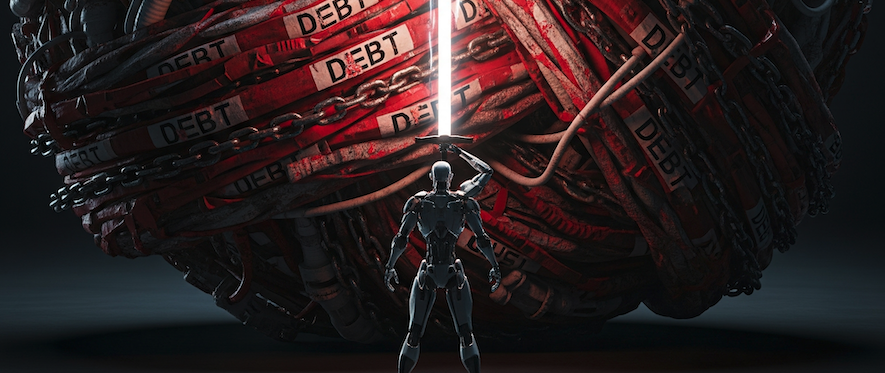

The real technological revolution that offers a path forward is not in financial gimmicks, but in artificial intelligence, LLMs, and robotics. Their promise is not magical “growth,” but something far more valuable: the ruthless elimination of waste, fraud, and abuse. The potential for automation to overhaul the medical and insurance industries—the true drivers of our debt—is immense. Imagine humanoid robots, like Tesla’s Optimus, providing comprehensive elder care. These machines could handle everything from showering a grandparent to monitoring their vitals, ending the soul-crushing and financially ruinous nursing home industry. This isn’t science fiction; it is a necessary step to slash the costs that are bankrupting our nation.

(more…)