Executive Summary

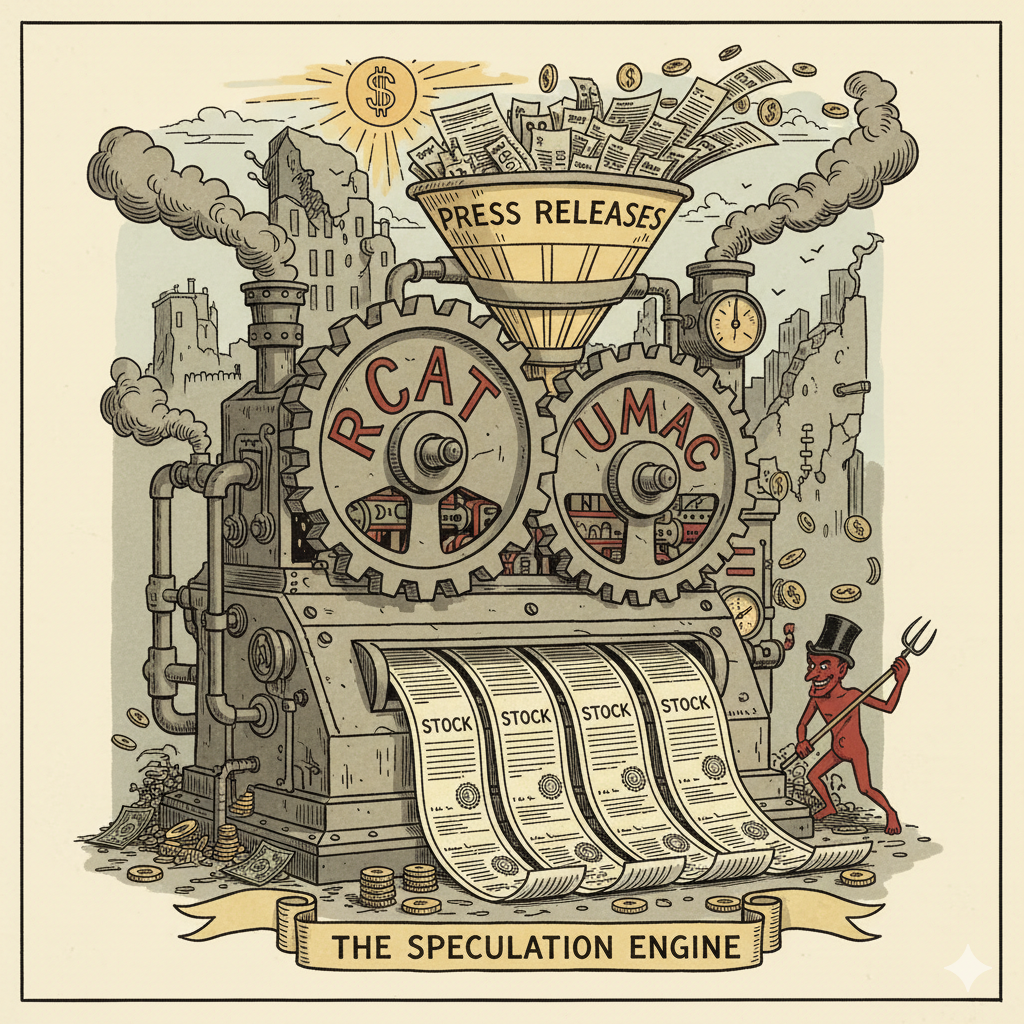

An in-depth investigation reveals a sophisticated and potentially fraudulent ‘Dilution-Hype Cycle.’ This cycle is at the core of Red Cat Holdings, Inc. (NASDAQ: RCAT) and Unusual Machines, Inc. (NYSE American: UMAC). The scheme appears strategically designed to perpetually extract capital from public markets.

This report details the interconnected corporate structure between the two companies. It analyzes the financial mechanics of their capital-raising activities and deconstructs their product and contract claims.

Our findings indicate the relationship between RCAT and UMAC is not a standard, arm’s-length corporate separation. It originated from RCAT’s divestiture of its consumer division. This move appears to be a strategic maneuver. It created a publicly-traded, controlled entity to facilitate a cycle of capital raising and stock promotion.

Key elements of this structure include:

- A Controlled Spin-Off: RCAT spun off its Rotor Riot and Fat Shark brands into UMAC. The transaction was paid for predominantly with UMAC stock, establishing RCAT as UMAC’s largest shareholder.

- Interlocking Management: A key RCAT executive was transferred to the CEO position at UMAC. This move ensures continued alignment and control.

- Non-Arm’s-Length Transactions: The interconnected relationship enables self-serving deals. A widely publicized $800,000 component order from RCAT to UMAC, for example, served to generate a positive news cycle and inflate the stock prices of both entities.

Both companies are characterized by significant and persistent unprofitability. This makes them dependent on the capital markets for survival. They service this dependency through a continuous pattern of dilutive stock offerings, frequently managed by a common underwriter, ThinkEquity. This process appears to be the core business model.

Furthermore, third-party analysis has challenged the veracity of the companies’ product claims and contract values. Allegations suggest key products are rebranded consumer drones with Chinese-made components. The analysis also claims the value of a pivotal government contract has been significantly overstated, creating a potential revenue shortfall of approximately $57 million.¹

These activities, viewed in aggregate, bear the hallmarks of a coordinated stock promotion and financing scheme. The scheme utilizes related-party transactions and a circular corporate structure. The primary objective appears to be generating hype to facilitate the continuous sale of equity, a practice that may not serve the best interests of independent shareholders.

Section 1: The Corporate Restructuring: An Analysis of the RCAT and UMAC Symbiotic Relationship

The intricate relationship between Red Cat Holdings (RCAT) and Unusual Machines (UMAC) has a clear foundation. It began with the strategic divestiture of RCAT’s consumer-facing assets. This transaction was not a simple sale. It was the genesis of a symbiotic corporate structure, characterized by interlocking ownership, shared management, and non-arm’s-length dealings.

Evidence suggests this restructuring was a deliberate maneuver. It created a new, publicly-traded vehicle that RCAT could effectively control. This control enabled a series of self-serving transactions designed primarily for stock promotion rather than genuine operational synergy.

1.1 The Divestiture of the Consumer Division: A Transaction Structured for Control

In November 2022, Red Cat announced a Stock Purchase Agreement (SPA). The agreement was to sell its consumer division to Unusual Machines.² This division consisted of the e-commerce store Rotor Riot and the FPV goggle manufacturer Fat Shark Holdings.² The initial announcement valued the deal at $20 million in cash and securities.²

However, a detailed examination of the final terms reveals a structure that heavily favored equity over cash. This fundamentally altered the nature of the deal. The finalized purchase price was $22.1 million, with the following composition:³

- Cash: $1.1 million³

- Promissory Note: A $2.0 million note issued by UMAC to RCAT³

- UMAC Stock: $17.0 million worth of UMAC’s common stock, equating to 4,250,000 shares at the IPO price of $4.00 per share³

On July 22, 2024, a working capital adjustment increased the purchase price by another $2.0 million. This amount was added to the promissory note, bringing its total to $4.0 million and further cementing the financial ties between the two entities.³

This structure demonstrates the divestiture was not a liquidity event for Red Cat. Instead of receiving cash, RCAT transformed its ownership of an operational division into a controlling equity stake in a new public company. The agreement explicitly stated that upon completion, Red Cat was “expected to be the largest shareholder in Unusual Machines”.²

The deal officially closed on February 22, 2024, cementing this new corporate relationship.⁴

1.2 Interlocking Management and Ownership: The Allan Evans Connection

Concurrent management changes further underscore the strategic nature of the divestiture. Allan Evans, then the Chief Operating Officer (COO) of Red Cat, departed the company. He became the Chief Executive Officer (CEO) of Unusual Machines, the very entity acquiring RCAT’s assets.²

This transfer of a high-level executive from seller to buyer is a significant red flag for corporate governance. This move fundamentally undermines the principle of independent oversight critical for public companies. It ensures the “new” company’s leadership is aligned with the strategic objectives of its former parent and current largest shareholder.

Red Cat’s CEO, Jeff Thompson, openly endorsed this arrangement.

“If the transaction is completed, Red Cat would become the largest shareholder in UM, and the shareholders of Red Cat will continue to benefit from Allan’s leadership skills.”²

This statement is revealing. It frames UMAC’s leadership as a continuation of service to RCAT’s shareholders, not as independent stewardship. The placement of a trusted former executive at UMAC’s helm negates the notion of an arm’s-length relationship. It solidifies a dynamic where RCAT’s interests can heavily influence UMAC’s corporate strategy.

1.3 The $800,000 Transaction: A Case Study in Manufactured News

The practical implications of this symbiotic relationship became clear on October 3, 2025. On that day, Unusual Machines announced a “significant $800,000 order” from Red Cat for drone components.⁵ The components were slated for integration into Red Cat’s new FANG drone, a product marketed for military use.⁶

The companies framed the announcement as a major commercial validation. UMAC’s EVP of Revenue highlighted the company’s “manufacturing readiness and speed-to-market capabilities”.⁷ RCAT’s CEO stated the partnership would deliver “high-performance, NDAA-compliant systems”.⁶

The market reaction was immediate and powerful. Following the news, shares of both companies surged. UMAC shares rose 11.98% to $16.76, while RCAT shares jumped 23.65% to $14.25.⁸

This deal cannot be analyzed as a standard commercial transaction. It is a transaction between two deeply intertwined, related parties. RCAT, as UMAC’s largest shareholder and with its former COO as UMAC’s CEO, was essentially placing an order with a company it controls.

The economic substance of this transaction is circular. Cash moves from RCAT to UMAC, which registers as revenue for UMAC. As UMAC’s largest shareholder, RCAT indirectly benefits from any appreciation in UMAC’s value. More importantly, both companies issued a press release announcing a “Key Supply Agreement.” This was a manufactured news event, specifically tailored through this related-party transaction, that served as a powerful catalyst for their stock prices.⁶

Section 2: The Capital Engine: An Investigation into Dilution, Underwriting, and Financial Viability

The corporate structure connecting RCAT and UMAC supports a financial engine designed for continuous capital raising. Both companies are fundamentally unprofitable and exhibit high cash burn rates. This makes them entirely dependent on public markets for survival.

This section investigates the history of shareholder dilution, the central role of underwriter ThinkEquity, and the underlying financial weakness that necessitates this model. The evidence points to a business model where the primary product sold is not drones, but company stock.

2.1 A History of Shareholder Dilution

SEC filings and press releases reveal a consistent pattern of raising capital through the issuance of new shares. This process dilutes the ownership stake of existing shareholders.

For Red Cat Holdings, this pattern is well-established.

- A December 2023 prospectus supplement details an offering of 16,000,000 shares at $0.50 per share.⁹ This was a significant discount to the last reported sale price of $0.76.⁹ The offering raised $8 million and was managed by ThinkEquity LLC.¹⁰

- In September 2025, RCAT announced a much larger public offering of 17,968,750 shares. This offering raised approximately $172.5 million in gross proceeds.¹¹

Unusual Machines has quickly adopted the same strategy. CEO Allan Evans disclosed that the company closed financings for $40 million and $48.7 million in mid-2025.¹² These capital raises substantially altered the company’s capitalization, increasing shares outstanding to over 30 million and providing over $81 million in cash.¹² This aggressive capital raising so soon after its February 2024 IPO points to substantial cash requirements that operational revenue cannot meet.³

The user’s recollection of a “crazy dilution…on Friday after hours” highlights a tactic companies sometimes use to release market-moving information with less scrutiny. The timing of an 8-K filing on Friday, September 19, 2025, announcing the closing of the massive $172.5 million offering, aligns with this pattern of behavior.¹³

2.2 The ThinkEquity Connection: Facilitator of the Ecosystem

The investment bank ThinkEquity is a common thread in the capital-raising activities of this network. The firm has consistently acted as the underwriter, book-runner, or placement agent.

- Red Cat Holdings (RCAT): ThinkEquity managed RCAT’s $16 million public offering in May 2021, a subsequent $60 million offering in July 2021, and the discounted $8 million offering in December 2023.¹⁴ ¹⁵ ¹⁰

- Draganfly (DPRO): In July 2021, Draganfly announced a $20 million public offering with ThinkEquity as the underwriter.¹⁶

- Drone-Pro (as Fundamental Global Inc.): A July 2025 SEC filing reveals a Placement Agency Agreement between Fundamental Global Inc. and ThinkEquity for an offering.¹⁷

The consistent use of a single boutique investment bank across a cluster of related, speculative, and unprofitable micro-cap companies (typically those with a market capitalization between $50 million and $300 million) is a significant data point. ThinkEquity’s recurring role suggests it is a key enabler of this ecosystem, raising questions about the level of independent due diligence performed.¹⁸

2.3 Analysis of Financial Health: The Unprofitability Engine

The relentless need for capital is rooted in one simple fact: neither RCAT nor UMAC is profitable. Their operations consume far more cash than they generate.

Red Cat’s financial statements paint a stark picture. For its second quarter, the company posted a loss of 15 cents per share, wider than analysts’ expectations. Its quarterly revenue of $3.22 million fell dramatically short of the $7.49 million consensus estimate.⁸ Financial data shows a deeply negative operating margin of -159.80% and a return on equity of -68.83%.¹⁹

Unusual Machines is in a similar position. For its second quarter of 2025, the company reported a loss of 32 cents per share, a substantial miss.⁸ The company’s own shareholder letter acknowledged an operating loss of approximately $7.2 million for that quarter alone.¹² SEC filings confirm this trend. For the nine months ending September 30, 2024, the company’s net loss had ballooned to $4,862,490.²⁰

This chronic unprofitability drives the entire corporate and financial structure. Because the companies cannot fund operations through sales, their survival depends on their ability to sell stock to the public. This transforms stock promotion into the central, life-sustaining function of the enterprise.

The “Dilution-Hype Cycle” is the business model. The cycle is clear:

- Generate hype through press releases and promotional narratives.

- Capitalize on the resulting stock price increase to launch a secondary stock offering.

- Use the cash raised to fund operations and compensate insiders.

- Repeat the cycle.

The user’s observation that “The stock was trading high and they diluted it” is a perfect description of this model in action.

The following table provides a data-driven summary of this pattern of capital raising.

| Date | Company | Ticker | Underwriter(s) | Shares/Units Offered | Price per Share/Unit | Gross Proceeds | SEC Filing Source |

| May 4, 2021 | Red Cat Holdings, Inc. | RCAT | ThinkEquity | 4,000,000 | $4.00 | $16,000,000 | ¹⁴ |

| July 21, 2021 | Red Cat Holdings, Inc. | RCAT | ThinkEquity | 13,333,334 | $4.50 | $60,000,000 | ¹⁵ |

| December 11, 2023 | Red Cat Holdings, Inc. | RCAT | ThinkEquity LLC | 16,000,000 | $0.50 | $8,000,000 | ¹⁰ |

| February 16, 2024 | Unusual Machines, Inc. | UMAC | N/A (IPO) | 1,250,000 | $4.00 | $5,000,000 | ³ |

| September 19, 2025 | Red Cat Holdings, Inc. | RCAT | Northland Capital Markets | 17,968,750 | $9.60 (approx.) | $172,500,000 | ¹¹ |

| Q2-Q3 2025 | Unusual Machines, Inc. | UMAC | N/A | N/A | N/A | $88,700,000 | ¹² |

2.4 Timeline of Key Events: The “Dilution-Hype Cycle” in Action

The sequence of corporate announcements, capital raises, and market-moving news illustrates the operational tempo of the “Dilution-Hype Cycle.”

| Date | Event | Company | Significance | Source |

| May 4, 2021 | $16M Public Offering | RCAT | Early-stage capital raise via ThinkEquity. | ¹⁴ |

| July 21, 2021 | $60M Public Offering | RCAT | Major capital raise via ThinkEquity. | ¹⁵ |

| Nov 2022 | Divestiture Announced | RCAT/UMAC | RCAT announces plan to spin off consumer brands to UMAC, making RCAT the largest shareholder. | ² |

| Dec 11, 2023 | $8M Public Offering | RCAT | Highly dilutive, discounted offering via ThinkEquity. | ¹⁰ |

| Feb 22, 2024 | Acquisition Closes | RCAT/UMAC | UMAC officially acquires Rotor Riot/Fat Shark, cementing the related-party structure. | ⁴ |

| Sep 19, 2025 | $172.5M Public Offering | RCAT | Massive capital raise following a period of stock promotion around its military pivot. | ¹¹ |

| Oct 3, 2025 | $800k Order Announced | RCAT/UMAC | Related-party transaction creates a positive news catalyst, boosting both stocks. | ⁵ |

| Oct 10, 2025 | Short Seller Report | RCAT/UMAC | Fuzzy Panda Research publishes report alleging fraud, misrepresentation, and Chinese parts. | ²¹ |

Section 3: Deconstructing the Narrative: An Assessment of Product Claims and Market Hype

The financial engine requires a constant supply of fuel: positive news and compelling narratives. This section critically examines the core marketing claims made by RCAT and UMAC. It contrasts them with evidence from an investigative short-seller report.

The analysis suggests the companies constructed a powerful narrative around national security and domestic manufacturing. This story is designed to resonate with investors but may mask significant product deficiencies and overstated commercial success. The story being sold may be more important than the products themselves.

3.1 The FANG Drone Controversy: A Rebranded Consumer Drone?

The FANG drone is the centerpiece of Red Cat’s pivot to the defense market. Company press releases consistently describe the FANG and its components as “American-made,” “NDAA-compliant,” and part of the Department of Defense’s prestigious “BLUE UAS” list.⁶ ⁵

However, an explosive report published by short-seller research firm Fuzzy Panda Research on October 10, 2025, directly challenges these claims.²¹ Short-sellers are inherently biased, as they profit from a stock’s decline. Nevertheless, their reports often contain detailed evidence that warrants critical examination.

The report makes several damaging allegations:

- Rebranded Product: The FANG drone is allegedly not a unique military system but a rebranded Rotor Riot consumer drone, which retails for approximately $650-$750.¹

- Chinese Components: The report includes photographs allegedly showing the FANG drone equipped with key components manufactured in China, including motors from BrotherHobby and an antenna from CaddxFPV.²¹

- “Marketing Concept”: The report’s most damaging claim comes from legal documents, which it alleges describe the FANG drone as:

“…’nothing more than a marketing concept’ and ‘a failed project that had been suspended in the fall of 2024.’”¹

If these allegations are accurate, the foundation of Red Cat’s military-focused strategy is compromised. It suggests the company is leveraging national security concerns to market a product that may not meet the standards it purports to champion. As of October 11, 2025, Red Cat had not issued a public response to these specific allegations.²²

3.2 “American-Made” Marketing vs. Geopolitical Reality

The marketing strategy of both RCAT and UMAC is astutely timed. Their communications are saturated with keywords like “onshoring drone production” and “domestic supply chain”.²³ ²⁴ This narrative aligns perfectly with a growing consensus in Washington to reduce reliance on Chinese technology.

This sentiment is embodied in legislation such as the Countering CCP Drones Act (H.R.2864). This bill, which passed the House, targets the world’s largest drone manufacturer, DJI.²⁵ It requires the FCC to add DJI’s equipment to a list of technologies posing an unacceptable risk to U.S. national security.²⁵ Such legislation creates a significant market opportunity for domestic manufacturers.

RCAT and UMAC have positioned themselves as direct beneficiaries of this political tailwind. They have crafted a simple story for investors: “As Chinese drones are banned, our American-made drones will fill the void.” The alleged use of Chinese components in their flagship “American-made” drone would render this marketing narrative profoundly deceptive.

3.3 Contract Value and Revenue Projections: A Pattern of Overstatement?

The Fuzzy Panda Research report also attacks Red Cat’s narrative about its contract values. The report alleges the company has misled investors about the true value of its cornerstone military contract.

The report focuses on the Army’s Short-Range Reconnaissance (SRR) contract. It claims that while management and analysts led investors to believe the contract’s initial phase was worth between $30 million and $55 million, the reality is far different. Citing information purportedly from a Freedom of Information Act (FOIA) request, the report asserts the contract is worth only $12.9 million.¹

The financial implications of such a discrepancy are severe. Fuzzy Panda argues that with this smaller contract value, it is virtually impossible for Red Cat to achieve its fiscal year 2025 revenue guidance of $80 million to $120 million. The report calculates a potential revenue shortfall of approximately $57 million.¹ This allegation, if true, strikes at the heart of the company’s credibility and suggests a fundamental misrepresentation of its commercial traction.

Section 4: A Lexicon of Potential Market Manipulation: Defining the “Scam”

This section provides a technical framework for the patterns observed in the preceding sections. It defines the financial and legal concepts that characterize the suspected activities of Red Cat Holdings and Unusual Machines. While only regulators and courts can make a definitive legal judgment, the observed behavior exhibits strong characteristics of several recognized forms of market malfeasance.

4.1 Related-Party Transactions and Conflicts of Interest

Definition: A related-party transaction is a business deal between two parties joined by a pre-existing special relationship. The SEC requires disclosure of any such transaction exceeding $120,000 where a related party has a direct or indirect material interest. Related parties include directors, executive officers, and significant shareholders (owning more than 5%).²⁶

Application: The RCAT-UMAC ecosystem is built on related-party transactions. The initial sale of Rotor Riot from RCAT to UMAC was not an arm’s-length transaction.² The subsequent $800,000 component purchase order from RCAT to UMAC is a clear transaction between a company and an entity it effectively controls.⁵

Significance: These transactions lack the competitive tension of a genuine market. Their terms and timing appear orchestrated by insiders. The $800,000 order seems designed less for operational necessity and more for its ability to generate a promotional press release, benefiting the stock prices of both entities.

4.2 Pump and Dump Scheme Characteristics

Definition: A “pump and dump” is a form of securities fraud. It involves artificially inflating a stock’s price (the “pump”) through false or misleading positive statements. The perpetrators then sell their shares (the “dump”) at the high price. These schemes typically target micro-cap stocks, which are more susceptible to manipulation.²⁷

Application: The behavior in the RCAT-UMAC ecosystem exhibits strong characteristics of a modified pump and dump scheme.

- The “Pump”: A continuous promotional campaign exists. It includes press releases announcing partnerships, product launches, and alignment with powerful geopolitical narratives.⁶ ²³

- The “Dump”: In this variation, the primary “dumper” is not just an insider selling personal shares, but the company itself. Following periods of promotion and stock price appreciation, the company issues millions of new shares to the public through secondary offerings.¹⁰ ¹¹

Significance: This framework explains the “Dilution-Hype Cycle.” The promotion is a necessary prerequisite to create an inflated market into which the company can sell its own stock to fund its unprofitable operations.

4.3 Circular Ownership and Control

Definition: Circular ownership describes a corporate structure where a network of companies own stakes in each other, creating a loop of ownership or control. This structure can reduce transparency, obscure the identity of ultimate beneficial owners, and facilitate illicit activities by allowing insiders to manufacture transactions that appear legitimate but are internally orchestrated.²⁸

Application: The RCAT-UMAC relationship functions as a form of circular control. RCAT is the largest shareholder of UMAC, its key supplier.² This creates a closed loop. RCAT can generate revenue for UMAC by placing purchase orders. This “revenue” can support UMAC’s valuation. As the largest holder of UMAC stock, RCAT benefits directly from this appreciation.

Significance: This structure provides insiders with a powerful tool to generate “news” and the appearance of commercial traction on demand. It blurs the line between genuine business activity and financial engineering.

4.4 Insider Trading and FINRA Rules

Definition: Illegal insider trading involves buying or selling a security, in breach of a fiduciary duty, while in possession of material, non-public information.²⁹ Separately, the Financial Industry Regulatory Authority (FINRA) has strict rules governing the conduct of member firms to prevent conflicts of interest and ensure proper supervision.³⁰ ³¹

Application: The research contains no direct evidence of illegal insider trading. However, the ecosystem is structured in a way that creates significant opportunities and risks for such activity. Key executives at RCAT, UMAC, and their underwriter ThinkEquity are privy to the timing and terms of material events before they are public. Any trading by these individuals around these events would warrant intense regulatory scrutiny.

Section 5: Conclusion: A Framework for Investor Due Diligence

5.1 Synthesis of Findings and Final Assessment

The analysis of Red Cat Holdings and Unusual Machines reveals a sophisticated and legally complex ecosystem. While individual corporate actions may be presented as legitimate, the aggregate pattern of behavior suggests a coordinated scheme. This scheme appears designed to leverage public capital markets for the primary benefit of insiders.

The foundation is the non-arm’s-length relationship established through the spin-off. This created a publicly-traded supplier, UMAC, that remains under the de facto control of its largest customer and shareholder, RCAT. This structure enables the manufacturing of positive news catalysts, which serve to “pump” the stock prices of both entities.

This promotional activity is a crucial component of the core business model, which is necessitated by the deep and persistent unprofitability of both companies. The ultimate goal of the “pump” is to create favorable conditions for the “dump”: the frequent issuance of millions of new shares to the public in dilutive offerings.

The narrative used to fuel this cycle is powerful. It is built on compelling themes of U.S. national security and domestic manufacturing. However, credible, evidence-based allegations seriously undermine its credibility.

In direct response to the user’s query, the observed activities are best described as a “coordinated stock promotion and financing scheme utilizing related-party transactions and a circular corporate structure.” The primary objective is not the profitable sale of drone technology, but the perpetual sale of equity to the public.

5.2 Recommendations for the Prudent Investor: Red Flags from the RCAT Case Study

The intricate web surrounding RCAT and UMAC serves as a valuable case study. The following red flags can help identify potentially fraudulent investment opportunities:

- Scrutinize Corporate Restructurings: Be deeply skeptical of spin-offs where payment is primarily in stock, especially when accompanied by the transfer of key executives. This often signals retained control, not a true separation of assets.

- Follow the Underwriter: Investigate the investment bank that underwrites a company’s offerings. If that underwriter consistently services a cluster of similar, speculative, and interconnected companies, it may indicate a promotional ecosystem.

- Treat Related-Party Revenue with Extreme Skepticism: Revenue generated from a company’s largest shareholder or other related party should be heavily discounted. It is not validated by a competitive market and can be manufactured to create the illusion of growth.

- Juxtapose Narrative with Financials: An exciting story is not a substitute for a viable business. If a company’s story is one of explosive growth, but its financial statements show widening losses and a ballooning share count, the narrative is likely a distraction.

- Verify, Don’t Trust: Do not take claims like “American-made” or “NDAA-compliant” at face value. Seek independent, third-party verification. A credible, detailed short-seller report is a significant signal that warrants a deeper investigation.

The RCAT-UMAC case serves as a stark reminder: in this ecosystem, the narrative may be the product, not the technology.

Glossary of Terms

- Arm’s-Length Transaction: A transaction in which the buyers and sellers of a product act independently and have no relationship to each other, ensuring the transaction is fair and reflects market value.

- Dilution: A reduction in the ownership percentage of a share of stock caused by the issuance of new shares.

- NDAA-compliant: Refers to products that comply with the National Defense Authorization Act, which includes provisions restricting the U.S. Department of Defense from procuring or using certain telecommunications and video surveillance equipment from specific Chinese companies.⁵

- Prospectus Supplement: A document filed with the SEC that updates or adds information to a previously filed prospectus, often used to detail the specific terms of a new stock offering.

- Pump and Dump: A form of securities fraud that involves artificially inflating the price of a stock (the “pump”) through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price (the “dump”).²⁷

- Related-Party Transaction: A business deal or arrangement between two parties who are joined by a pre-existing special relationship, such as a company and its largest shareholder or a company and its CEO.²⁶

Works Cited

- Fuzzy Panda Research. “RCAT – FOIAs Reveal Key Army Contract Way Smaller Than Claimed.” October 10, 2025. https://fuzzypandaresearch.com/rcat-army-contract-smaller-than-claimed/

- Red Cat Holdings, Inc. “Red Cat Announces Management Changes.” Press Release. November 29, 2022. https://ir.redcatholdings.com/news-events/press-releases/detail/121/red-cat-announces-management-changes

- U.S. Securities and Exchange Commission. “Form 424B3: Prospectus filed pursuant to Rule 424(b)(3) for Unusual Machines, Inc.” December 17, 2024. https://www.sec.gov/Archives/edgar/data/1956955/000168316824008787/umac_424b3.htm

- Unusual Machines, Inc. “Unusual Machines Completes Acquisitions of Fat Shark and Rotor Riot.” GlobeNewswire. February 22, 2024. https://www.globenewswire.com/news-release/2024/02/22/2834055/0/en/Unusual-Machines-Completes-Acquisitions-of-Fat-Shark-and-Rotor-Riot.html

- Investing.com. “Unusual Machines receives $800,000 order from Red Cat Holdings.” October 3, 2025. https://www.investing.com/news/company-news/unusual-machines-receives-800000-order-from-red-cat-holdings-93CH-4270492

- Streetwise Reports. “Drone Co. Secures Major Order From Partner for Components.” October 6, 2025. https://www.streetwisereports.com/article/2025/10/06/drone-co-secures-major-order-from-partner-for-components.html

- Webull. “Unusual Machines Lands $800K Red Cat Drone Parts Order.” October 3, 2025. https://www.webull.com/news/13618130514695168

- Benzinga. “Unusual Machines Lands $800K Red Cat Drone Parts Order.” October 3, 2025. https://www.benzinga.com/trading-ideas/movers/25/10/48018674/unusual-machines-lands-800k-red-cat-drone-parts-order

- U.S. Securities and Exchange Commission. “Form 424B5: Prospectus filed pursuant to Rule 424(b)(5) for Red Cat Holdings, Inc.” December 7, 2023. https://www.sec.gov/Archives/edgar/data/748268/000155479523000364/rcat1207prospectus424b5.htm

- Red Cat Holdings, Inc. “424B5: Prospectus filed pursuant to Rule 424(b)(5).” SEC Filing. December 7, 2023. https://ir.redcatholdings.com/sec-filings/all-sec-filings/content/0001554795-23-000364/rcat1207prospectus424b5.htm

- Quiver Quantitative. “Red Cat Holdings, Inc. Announces Pricing of $172.5 Million Public Offering of Common Stock.” September 19, 2025. https://www.quiverquant.com/news/Red+Cat+Holdings%2C+Inc.+Announces+Pricing+of+%24172.5+Million+Public+Offering+of+Common+Stock

- Morningstar. “Unusual Machines Issues Letter to Shareholders.” August 27, 2025. https://www.morningstar.com/news/accesswire/1061148msn/unusual-machines-issues-letter-to-shareholders

- Finviz. “Red Cat Holdings, Inc. (RCAT) SEC Filings.” Accessed October 11, 2025. https://finviz.com/quote.ashx?t=RCAT&ty=lf

- U.S. Securities and Exchange Commission. “Form 8-K, Exhibit 99.1 for Red Cat Holdings, Inc.” May 4, 2021. https://www.sec.gov/Archives/edgar/data/748268/000155479521000156/rcat0504form8kexh99_1.htm

- Red Cat Holdings, Inc. “Red Cat Holdings, Inc. Announces Pricing of Public Offering.” Press Release. July 16, 2021. https://ir.redcatholdings.com/news-events/press-releases/detail/31/red-cat-holdings-inc-announces-pricing-of-public-offering

- Draganfly Inc. “Draganfly Announces Pricing of US$20 Million Public Offering in the United States and Common Shares to Begin Trading on Nasdaq.” Press Release. July 29, 2021. https://www.sec.gov/Archives/edgar/data/1786286/000110465921098374/tm2123715d1_ex99-1.htm

- U.S. Securities and Exchange Commission. “Form 8-K for Fundamental Global Inc.” July 29, 2025. https://www.sec.gov/Archives/edgar/data/1591890/000164117225021498/form8-k.htm

- ThinkEquity. “Corporate Access.” Accessed October 11, 2025. https://www.think-equity.com/corporate-access

- Finviz. “Red Cat Holdings, Inc. (RCAT) Stock Quote.” Accessed October 11, 2025. https://finviz.com/quote.ashx?t=RCAT&ty=lf

- U.S. Securities and Exchange Commission. “Form 10-Q for Unusual Machines, Inc. for the quarterly period ended September 30, 2024.” November 14, 2024. https://www.sec.gov/Archives/edgar/data/1956955/000168316824008108/unusual_i10q-093024.htm

- Fuzzy Panda Research. “FANG Exposed as Nothing More Than a ‘Marketing Concept’ Made with CHINESE Parts.” October 10, 2025. https://fuzzypandaresearch.com/rcat-army-contract-smaller-than-claimed/

- Investing.com. “Red Cat stock falls after Fuzzy Panda issues short report.” October 10, 2025. https://www.investing.com/news/stock-market-news/red-cat-stock-falls-after-fuzzy-panda-issues-short-report-93CH-4281860

- Nasdaq. “Red Cat Becomes First U.S.-Based Drone Manufacturer to Source Motors From Unusual Machines.” February 26, 2025. https://www.nasdaq.com/press-release/red-cat-becomes-first-us-based-drone-manufacturer-source-motors-unusual-machines-2025

- sUAS News. “Unusual Machines Selected to Provide the First Drone for Red Cat’s FANGTM Line of First-Person-View Strike Systems.” July 2024. https://www.suasnews.com/2024/07/unusual-machines-selected-to-provide-the-first-drone-for-red-cats-fangtm-line-of-first-person-view-strike-systems/

- U.S. Congress. “H.R.2864 – Countering CCP Drones Act.” Accessed October 11, 2025. https://www.congress.gov/bill/118th-congress/house-bill/2864

- Winston & Strawn LLP. “Related-Party Transactions: A Guide for Public Companies.” October 2024. https://www.winston.com/a/web/5ZXTuUYKHnT6WxK4uPpCB/pubco_related-party-transactions-guide-2024_oct2024.pdf

- Investor.gov. “Pump and Dump Schemes.” Accessed October 11, 2025. https://www.investor.gov/introduction-investing/investing-basics/glossary/pump-and-dump-schemes

- Moody’s. “Circular ownership and complex corporate structuring.” Accessed October 11, 2025. https://www.moodys.com/web/en/us/kyc/resources/insights/circular-ownership-and-complex-corporate-structuring.html

- Cornell Law School Legal Information Institute. “Insider trading.” Accessed October 11, 2025. https://www.law.cornell.edu/wex/insider_trading

- FINRA. “Rule 3280. Private Securities Transactions of an Associated Person.” Accessed October 11, 2025. https://www.finra.org/rules-guidance/rulebooks/finra-rules/3280

- FINRA. “Rule 3210. Accounts At Other Broker-Dealers and Financial Institutions.” Accessed October 11, 2025. https://www.finra.org/rules-guidance/rulebooks/finra-rules/3210

Leave a Reply

You must be logged in to post a comment.