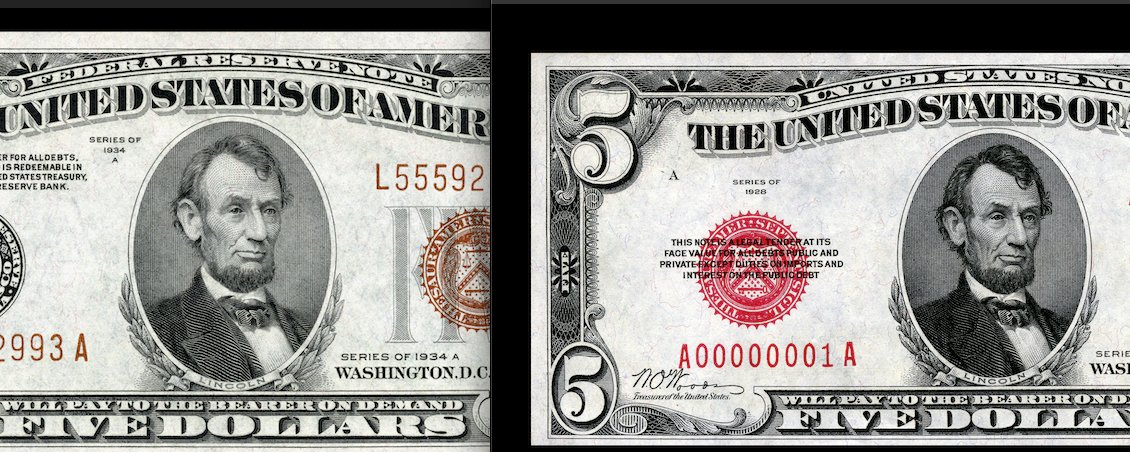

United States Notes differed from the later Federal Reserve Notes primarily in their issuing authority and initial backing.

How United States Notes Initially Worked: United States Notes were first authorized by the First Legal Tender Act in 1862 during the Civil War. They were issued directly by the U.S. Treasury to pay for war expenses and other government obligations. This meant the government itself was putting this money into circulation, essentially as a “bill of credit,” without involving lending or borrowing from a central bank. Initially, these notes, popularly known as “greenbacks,” were a form of fiat currency, meaning their value was based on government decree rather than being backed by a specific commodity like gold or silver that could be redeemed on demand. However, later, some United States Notes were redeemable for precious metal after the specie resumption of 1879. The early notes carried an obligation stating they were legal tender for all debts, public and private, except for duties on imports and interest on the public debt.