In the volatile intersection of cryptocurrency and artificial intelligence, IREN Ltd. has captured the market’s attention. The company’s audacious pivot from a specialized Bitcoin miner to a purported AI infrastructure powerhouse has ignited a firestorm of debate. This creates a textbook case for skeptical inquiry.

This investigation is therefore both timely and critical. It applies a rigorous analytical framework to a company whose narrative and valuation have far outpaced verifiable fundamentals. This leaves investors to question what they are witnessing: the birth of a new digital infrastructure giant or the inflation of a speculative bubble.

Glossary of Terms

- AI (Artificial Intelligence): A field of computer science focused on creating systems capable of performing tasks that typically require human intelligence.

- ARR (Annualized Run-Rate Revenue): A projection of future revenue based on current monthly or quarterly revenue, extrapolated over a full year. It is a forward-looking metric, not a historical result.

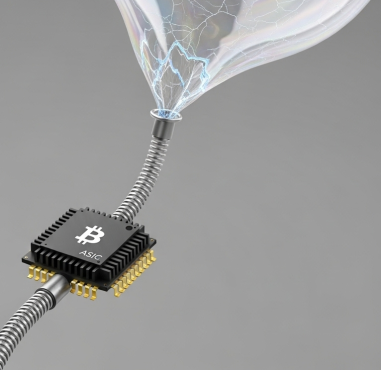

- ASIC (Application-Specific Integrated Circuit): A type of microchip designed for a specific purpose. In this context, ASICs are specialized for efficiently mining cryptocurrencies like Bitcoin.

- Convertible Note: A form of short-term debt that converts into equity. In IREN’s case, it is a long-term note that can be converted into the company’s stock under certain conditions.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): A measure of a company’s overall financial performance, used as an alternative to net income in some circumstances.

- EH/s (Exahashes per second): A unit of measurement for the computational power of a cryptocurrency mining network. One exahash is one quintillion ($10^{18}$) hashes per second.

- GPU (Graphics Processing Unit): A specialized electronic circuit whose parallel processing capabilities make it ideal for training and running AI models.

- HPC (High-Performance Computing): The practice of aggregating computing power to deliver much higher performance than a typical computer, used for solving large problems in science, engineering, or business.

- IFRS (International Financial Reporting Standards): A set of accounting rules for the financial statements of public companies intended to make them consistent, transparent, and easily comparable around the world.

- PUE (Power Usage Effectiveness): A ratio describing how efficiently a data center uses energy. It is the ratio of total facility energy to IT equipment energy. A lower PUE indicates a more efficient data center.

- RECs (Renewable Energy Certificates): Tradable commodities that represent proof that 1 megawatt-hour (MWh) of electricity was generated from an eligible renewable energy resource and delivered to the grid.

Executive Summary

This report presents a forensic analysis of IREN Ltd. The company has undergone a dramatic strategic pivot from a Bitcoin miner to a purported Artificial Intelligence (AI) infrastructure powerhouse. This transformation has fueled extreme stock price volatility. It has also attracted intense scrutiny from both bullish analysts and prominent short-sellers.

Our investigation, conducted through the Skeptical Researcher’s Framework, uncovers a pattern of aggressive, narrative-driven promotion. We found significant financial and operational risks, and a number of critical red flags. These findings question the sustainability of IREN’s current valuation and business model.

The analysis reveals a company whose market valuation appears decoupled from its verifiable operational reality. Key concerns center on several areas:

- The ambiguity of its “100% renewable energy” claims, which rely on direct sourcing in Canada but on purchasing Renewable Energy Certificates (RECs) in Texas.²⁹, ³⁰, ³¹, ³⁵, ³⁶

- The technical suitability of its infrastructure for high-performance computing (HPC).

- The conspicuous opacity of its customer base.

- The aggressive nature of its financial projections and capital-raising activities.

The critiques from short-sellers, particularly Jim Chanos and Culper Research, highlight a fundamental disconnect.¹⁰, ⁴⁷, ⁵⁴ This disconnect becomes clear when weighed against the company’s promotional materials and rebuttals from sell-side analysts. This situation warrants extreme caution.

The synthesis of findings does not reveal definitive evidence of outright fraud at this stage. Instead, it uncovers a high-risk venture. This venture is characterized by extreme hyperbole, significant undisclosed risks, and financial metrics indicative of a speculative bubble. The report concludes by enumerating the specific red flags that suggest a high probability of material misrepresentation to investors. We urge a deeply skeptical approach to the company’s forward-looking statements.

(more…)