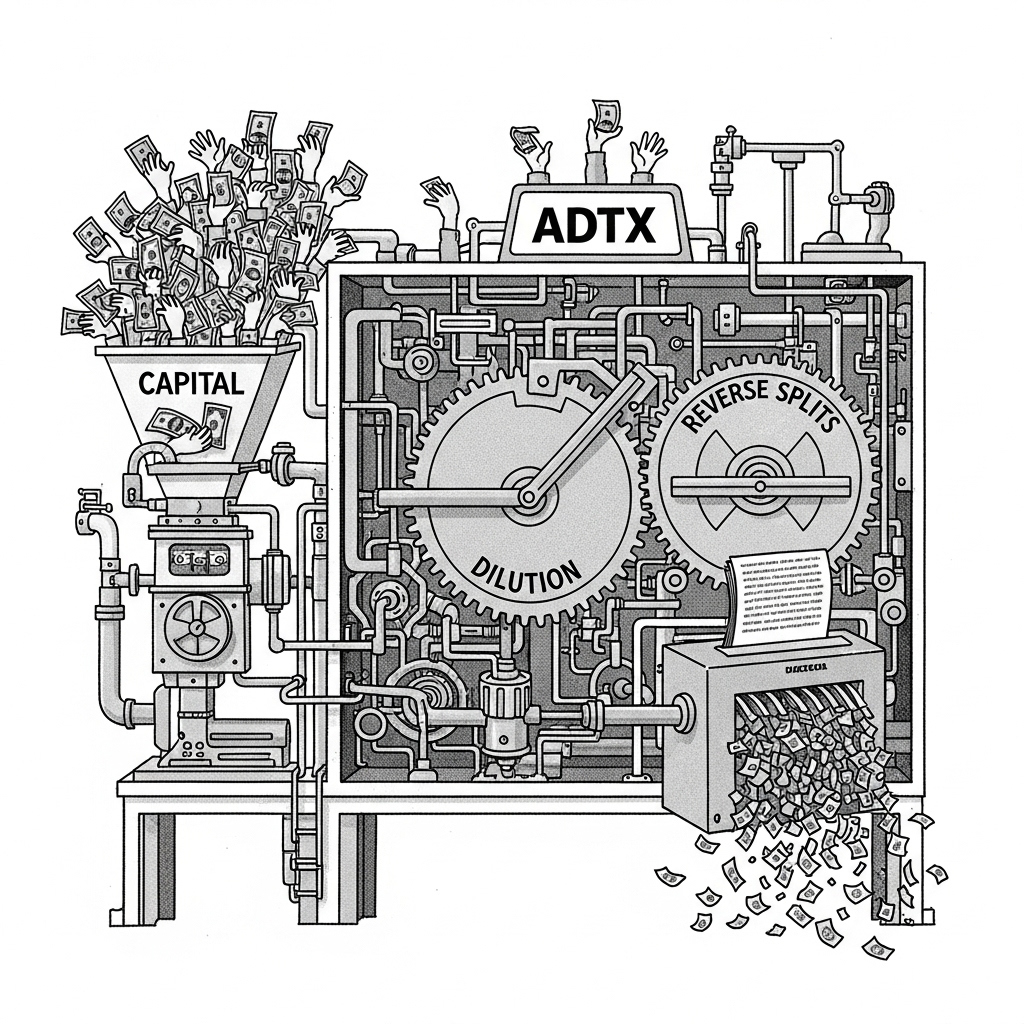

For investors in Aditxt, Inc. (NASDAQ: ADTX), the journey has been a brutal lesson in value destruction. This report deconstructs the anatomy of a company that has mastered the art of raising capital while systematically erasing it. Aditxt operates not as a viable biotechnology enterprise but as a perpetual financing vehicle. This vehicle is fueled by relentless shareholder dilution.

Through an analysis of its financial history, questionable strategic gambits, and a cycle of reverse stock splits, a clear thesis emerges. Aditxt’s business model is structurally engineered to benefit its operators at the direct expense of its public shareholders.

I. Executive Summary

This report provides an in-depth investigative analysis of Aditxt, Inc. (NASDAQ: ADTX). Aditxt is a biotechnology company that has attracted significant investor scrutiny. Since its 2017 inception and 2020 Initial Public Offering (IPO), Aditxt has operated as an “innovation platform.”¹ It pursues a strategy of acquiring and developing a disparate portfolio of preclinical and early-stage health technologies.² This investigation reveals a critical flaw: this strategy relies on a financial model of perpetual shareholder dilution. This model has led to a catastrophic destruction of market value.

The company has never achieved profitability. It consistently posts negligible revenues against multi-million-dollar net losses and a high cash burn rate. To fund these operations, Aditxt has raised over $109 million from capital markets since 2020.³ This relentless issuance of new shares has systematically eroded the stock’s value. The falling stock price has triggered multiple non-compliance notices from the Nasdaq exchange.

In response, the company executed a series of aggressive reverse stock splits. These included 1-for-50, 1-for-40, and 1-for-250 splits.⁴, ⁵, ⁶ These actions allowed Aditxt to procedurally maintain its Nasdaq listing. However, their cumulative effect has been devastating for long-term shareholders. The company’s market capitalization has collapsed to a fraction of the capital it raised.

A pivotal event was its audacious 2023 bid for the assets of the bankrupt diagnostic firm Lucira Health. Aditxt made the bid through its newly formed subsidiary, Pearsanta, Inc. The bid, valued at up to $35.9 million, was ultimately rejected.⁷ The court favored a competing offer from pharmaceutical giant Pfizer.⁸ The proceedings in the U.S. Bankruptcy Court for the District of Delaware exposed profound skepticism. The market and creditors doubted Aditxt’s financial capacity to fund such a transaction.⁹ This public failure validated the financial weaknesses long evident in the company’s public filings.

Aditxt’s executive team has backgrounds in finance and serial entrepreneurship. Their actions appear to prioritize financial engineering and narrative-driven capital raises. This focus comes at the expense of successfully commercializing a focused product. The company’s continued presence on the Nasdaq is not an endorsement of its business model. Instead, it is a function of a rule-based system that permits mechanisms like reverse splits to maintain listing requirements.

This analysis synthesizes financial data, SEC filings, and court documents. It deconstructs the operational and financial history of Aditxt. The result is a clear, evidence-based explanation for the concerns that have defined its public market existence.

(more…)