In the high-stakes world of corporate finance and technology, “100% renewable” has become the ultimate marketing slogan. But for Iren Ltd., a major player in the energy-hungry sectors of Bitcoin mining and AI, this claim rests on a complex and controversial system of accounting. This system separates paper promises from the physical reality of the Texas power grid.

This report peels back the layers of this green claim. It investigates whether the claim represents a genuine commitment to sustainability or a sophisticated exercise in “greenwashing,” enabled by a unique confluence of energy markets and political will.

Executive Summary

This report provides a comprehensive investigation into the “100% renewable energy” claims made by Iren Ltd. (NASDAQ: IREN). The company makes these claims for its energy-intensive cryptocurrency mining and Artificial Intelligence (AI) cloud operations in Texas.

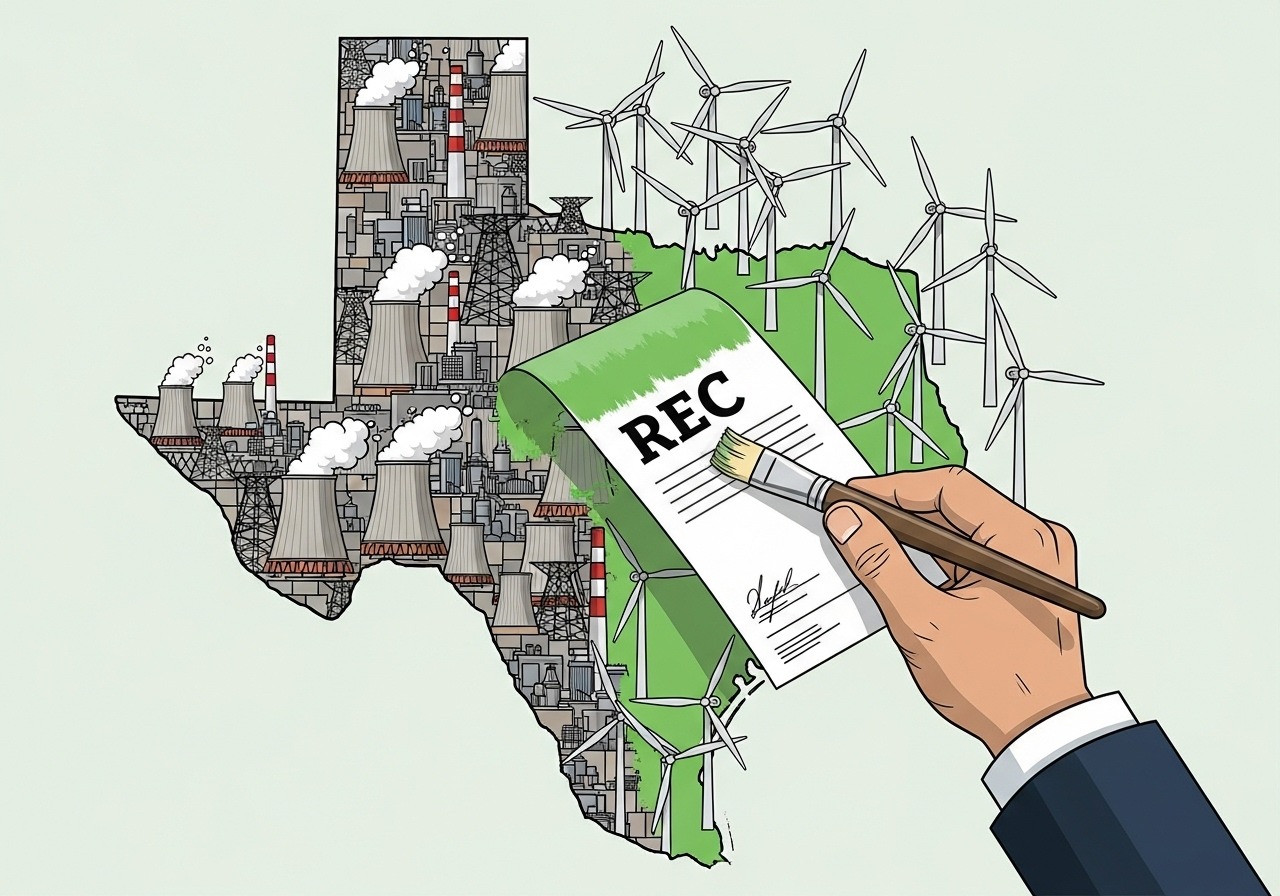

Framed through a skeptical research lens, our analysis concludes that IREN’s claims are technically permissible under current market-based accounting rules. However, they leverage the systemic ambiguity of the unbundled Renewable Energy Certificate (REC) system. This strategy presents a substantively misleading picture of the company’s actual environmental impact. Its operations physically consume power from a Texas grid overwhelmingly dominated by natural gas.

The investigation reveals a clear pattern. IREN’s public emphasis on its renewable credentials intensified in direct correlation with its strategic pivot from the volatile Bitcoin mining sector. The company moved toward the more lucrative and ESG-sensitive corporate AI market.

The purchase of unbundled RECs serves as a cost-effective marketing and compliance tool. It allows the company to re-label the fossil-fuel-generated electricity it physically draws from the grid as “100% renewable.” This practice is legal but lacks “additionality”—the crucial principle that a green investment should spur the creation of new renewable energy capacity.

This strategy is uniquely enabled by a confluence of factors in Texas. These include a deregulated, isolated, and natural gas-heavy power grid (ERCOT); a state-administered REC market; and an overtly supportive political establishment that has actively courted the crypto-mining industry.

The report argues that the massive influx of energy-intensive miners making such green claims is paradoxically reinforcing the state’s dependence on fossil fuels. This influx creates a level of electricity demand that necessitates the construction of new natural gas power plants to ensure grid stability.

Ultimately, IREN’s approach is not an isolated anomaly. It is symptomatic of a broader, systemic loophole in corporate climate reporting that prioritizes accounting abstraction over demonstrable decarbonization. This report recommends that investors, clients, and regulators exercise heightened due diligence. They should look beyond simplistic REC-based claims to demand greater transparency regarding physical energy sourcing, direct power purchase agreements, and verifiable additionality to accurately assess corporate environmental performance.

(more…)