In the high-stakes world of corporate finance and technology, “100% renewable” has become the ultimate marketing slogan. But for Iren Ltd., a major player in the energy-hungry sectors of Bitcoin mining and AI, this claim rests on a complex and controversial system of accounting. This system separates paper promises from the physical reality of the Texas power grid.

This report peels back the layers of this green claim. It investigates whether the claim represents a genuine commitment to sustainability or a sophisticated exercise in “greenwashing,” enabled by a unique confluence of energy markets and political will.

Executive Summary

This report provides a comprehensive investigation into the “100% renewable energy” claims made by Iren Ltd. (NASDAQ: IREN). The company makes these claims for its energy-intensive cryptocurrency mining and Artificial Intelligence (AI) cloud operations in Texas.

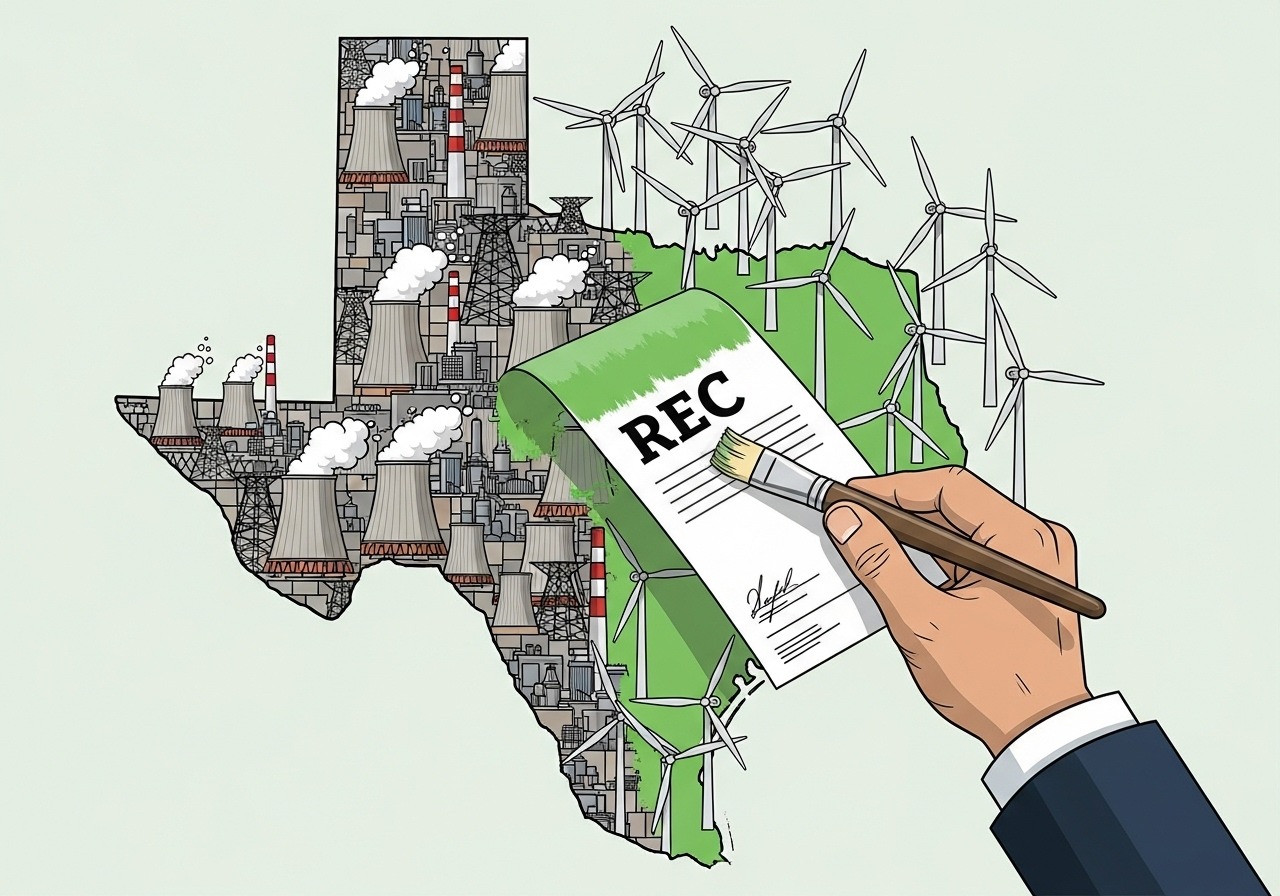

Framed through a skeptical research lens, our analysis concludes that IREN’s claims are technically permissible under current market-based accounting rules. However, they leverage the systemic ambiguity of the unbundled Renewable Energy Certificate (REC) system. This strategy presents a substantively misleading picture of the company’s actual environmental impact. Its operations physically consume power from a Texas grid overwhelmingly dominated by natural gas.

The investigation reveals a clear pattern. IREN’s public emphasis on its renewable credentials intensified in direct correlation with its strategic pivot from the volatile Bitcoin mining sector. The company moved toward the more lucrative and ESG-sensitive corporate AI market.

The purchase of unbundled RECs serves as a cost-effective marketing and compliance tool. It allows the company to re-label the fossil-fuel-generated electricity it physically draws from the grid as “100% renewable.” This practice is legal but lacks “additionality”—the crucial principle that a green investment should spur the creation of new renewable energy capacity.

This strategy is uniquely enabled by a confluence of factors in Texas. These include a deregulated, isolated, and natural gas-heavy power grid (ERCOT); a state-administered REC market; and an overtly supportive political establishment that has actively courted the crypto-mining industry.

The report argues that the massive influx of energy-intensive miners making such green claims is paradoxically reinforcing the state’s dependence on fossil fuels. This influx creates a level of electricity demand that necessitates the construction of new natural gas power plants to ensure grid stability.

Ultimately, IREN’s approach is not an isolated anomaly. It is symptomatic of a broader, systemic loophole in corporate climate reporting that prioritizes accounting abstraction over demonstrable decarbonization. This report recommends that investors, clients, and regulators exercise heightened due diligence. They should look beyond simplistic REC-based claims to demand greater transparency regarding physical energy sourcing, direct power purchase agreements, and verifiable additionality to accurately assess corporate environmental performance.

Section 1: The Anatomy of a Modern Green Claim

Deconstructing “100% Renewable”

In an era where “sustainability” can be the difference between securing a multi-million dollar AI contract and being sidelined, the claim of being “100% renewable” has become corporate gold.

But what does this claim truly mean when the electricity is drawn from a fossil-fuel-dominated grid?

This investigation rests upon the specific language Iren Ltd. employs and the financial instruments it uses to substantiate its environmental marketing. This section deconstructs the company’s central claim. It also provides a technical explanation of the Renewable Energy Certificate (REC) system. The focus is on the critical distinction between the legal attributes of renewable energy and the physical delivery of electrons to IREN’s facilities.

1.1 Iren Ltd.’s Qualified Promise

Iren Ltd. has built its corporate identity around the concept of sustainable high-performance computing. The most prominent articulation of this strategy appears on its corporate website. The site describes its data centers as “powered by 100% renewable energy”.¹

This definitive statement, however, is immediately qualified by a crucial parenthetical clarification: “(*from clean or renewable energy sources or through the purchase of RECs)”.¹ This asterisked addendum is the central source of the claim’s ambiguity and the primary subject of this analysis.

This specific phrasing is not an isolated instance. It is a consistent and deliberate messaging strategy deployed across the company’s most important communications.

In its full-year financial results for both fiscal year 2024 and 2025, the boilerplate “About IREN” section describes the company as “utilizing 100% renewable energy including through the purchase of RECs”.²,³ The repetition of this qualified language in official financial reports indicates that the reliance on RECs is a cornerstone of the company’s formal ESG and operational strategy. It is intended to satisfy investors, clients, and regulators.

1.2 Renewable Energy Certificates (RECs) as Market Instruments

To understand the substance of IREN’s claim, one must first understand the mechanics of the instrument it relies upon.

A Renewable Energy Certificate (REC), also known as a green tag, is a market-based instrument. It represents the property rights to the environmental, social, and other non-power attributes of one megawatt-hour ($MWh$) of renewable electricity generation.⁴

When a renewable facility—such as a wind turbine or solar farm—generates one $MWh$ of electricity and delivers it to the grid, one REC is created.⁴

The REC system was a solution to a fundamental physical problem. Once electricity enters the grid, the electrons from a solar panel are physically indistinguishable from those generated by a coal or natural gas plant.⁵

RECs were designed as a tracking and accounting mechanism. They “tag” each $MWh$ of renewable generation, making the “renewable-ness” a distinct, quantifiable, and tradable commodity.⁶ The owner of the REC possesses the exclusive legal right to claim they are “using” that renewable electricity.⁴

To prevent double-counting, each REC is assigned a unique serial number. It is tracked in a registry system from its creation to its final “retirement” by the end-user.⁵,⁶

1.3 The Great Decoupling: Unbundled RECs and “Null Power”

The ambiguity in IREN’s claim is enabled by a market feature known as “unbundling.” A renewable energy generator can sell two distinct products from its single act of generation: the physical electricity and the REC.⁷,⁸

When these are sold together to the same buyer, it is a “bundled” transaction. However, they can also be sold separately. A generator can sell its physical power into the local grid market. It can then sell the corresponding REC to a completely different buyer, potentially located hundreds of miles away.⁷

This creates two derivative products:

- An “unbundled” REC is a certificate for renewable attributes sold separately from the physical electricity.

- The physical electricity, stripped of its renewable attributes, is a commodity referred to as **”null power.”**⁶

A company like IREN in Texas can physically draw power from its local grid connection. This power reflects the grid’s actual generation mix. Simultaneously, IREN can purchase unbundled RECs from renewable projects located elsewhere in the state.

By purchasing and retiring RECs equal to its consumption, IREN can legally claim it is “100% renewable.” It effectively uses the certificates to re-label the “null power” it physically consumes. The U.S. Environmental Protection Agency (EPA) explicitly describes this practice, known as REC arbitrage, as a legitimate green power procurement strategy.⁴

The critical takeaway is that IREN’s “100% renewable” claim is not a statement about its physical operations. It is a legally constructed marketing and accounting assertion. It is a declaration of ownership over renewable attributes, not a description of the actual electrons powering its servers.

The physical power consumed by IREN’s data centers in Texas is, with high probability, generated predominantly from fossil fuels. The company’s claim is an exercise in accounting. It purchases the right to say it is powered by renewables. This distinction is fundamental to a skeptical evaluation of the company’s environmental impact.

Section 2: The Texas Nexus

A Confluence of Power, Politics, and Profit

Iren Ltd.’s business model is not viable in a vacuum. It is predicated on a unique ecosystem found in Texas. Here, a deregulated energy market, a state-sanctioned system for trading renewable attributes, and a deeply supportive political establishment converge. This creates an ideal habitat for energy-intensive industries like cryptocurrency mining and AI data centers.

2.1 The ERCOT Grid: An Island of Deregulation and Natural Gas

The Texas energy market is unlike any other in the United States. The Electric Reliability Council of Texas (ERCOT) manages an electrical grid that is largely isolated from the two main national grids.⁹,¹⁰ This structure was a deliberate historical choice to avoid federal regulation, granting the state significant autonomy over its energy market.¹⁰ ERCOT serves approximately 90% of the state’s electrical load.⁹,¹¹

This independence has fostered a fiercely competitive and deregulated wholesale market. This can result in some of the lowest industrial electricity prices in the nation—a primary attractant for voracious energy consumers like crypto miners.¹²

However, this market is powered by a generation fleet dominated by fossil fuels. Natural gas is the undisputed backbone of the ERCOT grid. It provides the dispatchable power necessary to meet demand and balance the state’s significant wind and solar resources.

Table 1: ERCOT Grid Energy Mix (June 2024 – May 2025)

| Energy Source | Percentage of Total Generation |

| Fossil Fuels | ~62% |

| Natural Gas | ~50% |

| Coal | ~12% |

| Low-Carbon Sources | ~38% |

| Wind | ~22% |

| Solar | ~8% |

| Nuclear | ~7% |

| Other | <1% |

Data compiled from reports covering the Texas electricity mix for the 12-month period ending May 2025.¹³ The “Other” category includes sources such as biomass and hydropower.¹⁴

This heavy reliance on natural gas establishes the fundamental contradiction at the heart of IREN’s claims. Any large-scale consumer connected to the ERCOT grid is, for the majority of the time, drawing power generated by burning fossil fuels.

Furthermore, the grid faces immense reliability challenges, underscored by the catastrophic 2021 winter storm.⁹ The massive new demand from data centers and crypto miners is exacerbating this strain. Projections indicate this sector will drive electricity demand growth in ERCOT at an average rate of 11% annually in 2025 and 2026.¹⁵

To ensure the grid can handle this new load, Texas is actively turning to the construction of new natural gas power plants. This program is supported by the taxpayer-backed $10 billion Texas Energy Fund.¹⁰,¹⁶

2.2 The Texas REC Program: A State-Sanctioned Market for Green Claims

The Texas REC program is the mechanism that allows IREN to bridge the gap between its marketing and the grid’s physical reality. The Public Utility Commission of Texas (PUCT) established the program, which ERCOT administers. It was designed to help the state meet its Renewable Portfolio Standard (RPS) goals.¹⁴,¹⁷

The program defines strict eligibility criteria for generators wishing to earn RECs. It permits facilities that rely exclusively on naturally regenerated sources like solar, wind, and biomass. It explicitly prohibits those derived from fossil fuels.¹⁴,¹⁸,¹⁹

ERCOT is responsible for managing REC trading accounts, certifying generators, and tracking the entire lifecycle of a REC.¹⁴,²⁰ While electricity retailers are required to participate to meet mandatory targets, the market is also open to voluntary participants like IREN. This state-sanctioned market provides the legal infrastructure for IREN to purchase the “renewable-ness” of a wind farm and apply that attribute to the grid power it consumes.

2.3 “Open for Crypto Business”: The Political Embrace of Mining

The final, critical element of the Texas nexus is the state’s political climate. Texas’s leadership, primarily within the Republican party, has actively and enthusiastically recruited the cryptocurrency mining industry. Following China’s crackdown on mining in 2021, Governor Greg Abbott famously declared that “Texas is open for Crypto business.”²¹,²²

Other influential figures echo this sentiment. U.S. Senator Ted Cruz has been a vocal champion, stating his desire for Texas to become the “center of the universe for bitcoin and crypto”.²¹,²³ He frames the industry’s values as being in “very natural synergy” with the state’s ethos of individual freedom and anti-regulatory sentiment.²¹

This political support has been translated into tangible policy. In 2021, the Texas Legislature passed two key bills:

- HB 4474: Formally recognized cryptocurrency in the state’s Uniform Commercial Code.²¹,²³

- HB 1576: Established a state-level blockchain working group to recommend favorable policies.²¹,²³

This warm political reception stands in stark contrast to growing opposition from local communities and federal lawmakers.¹⁶,²⁴ However, the state’s political machinery has consistently sided with the industry.

This confluence of factors creates a powerful dynamic. The influx of “green” crypto miners is a direct cause of increased strain on the ERCOT grid. To maintain reliability, the state is incentivizing the expansion of its natural gas infrastructure. The Texas REC market then functions as a crucial release valve. It allows companies like IREN to market themselves as “100% renewable” while physically relying on the gas-powered grid.

Section 3: A Timeline of Ambition and Ambiguity

Iren’s Pivot to AI (2022-2025)

The evolution of Iren Ltd.’s business strategy and its public messaging on energy use did not occur in a vacuum. A chronological analysis reveals a clear pattern. The “100% renewable energy” claim, substantiated by RECs, was elevated from a background feature to a central marketing pillar. This shift was a direct response to a strategic pivot from Bitcoin mining to the lucrative, and more ESG-conscious, market for enterprise AI infrastructure.

3.1 Genesis: Iris Energy and the ESG Imperative (2018-2023)

Iren Ltd. was founded in Sydney, Australia, in 2018 as Iris Energy by brothers Daniel and Will Roberts.²⁵,²⁶,²⁷,²⁸ The company’s foundational premise was that energy, not computing hardware, would be the ultimate limiting factor for digital growth.²⁹

The initial business model focused exclusively on Bitcoin mining, but with a strategic emphasis on “sustainable energy use” from its inception.³⁰ The company’s strategy involved siting its data centers in regions with access to “abundant, low-cost green energy,” such as areas with surplus hydropower.³⁰

This early positioning was a prescient response to the growing environmental, social, and governance (ESG) pressures on the cryptocurrency industry.³¹,³²,³³,³⁴ As the enormous energy consumption of Bitcoin became a subject of intense scrutiny, the industry sought to reframe its narrative. Iris Energy’s early focus on sustainability positioned it as a leader in this “green mining” movement.

3.2 The Pivot to AI and the Hardening of the “Green” Claim (2024-2025)

The economic realities of the crypto market created incentives for diversification.³⁵,³⁶ Beginning in late 2023 and accelerating through 2025, IREN executed a strategic pivot into AI cloud services. This move leveraged the company’s core competency in building and operating power-dense, high-performance computing (HPC) data centers.³⁰,³⁷

This strategic shift is meticulously documented in the company’s public disclosures. A flurry of announcements detailed the purchase of thousands of high-end NVIDIA GPUs and the securing of multi-year AI cloud contracts.²⁶,³⁸

As IREN began to court a new class of customer—large corporations and AI developers—the “100% renewable energy” claim became an indispensable marketing tool. The language in official reports was formalized and hardened.

The company’s FY24 Results, released in August 2024, noted the “Procurement of RECs, consistent with our commitment to utilizing 100% renewable energy”.² This phrasing became standard. Subsequent press releases consistently included the “utilizing 100% renewable energy including through the purchase of RECs” tagline.³,³⁸ The claim was no longer just part of the corporate story; it was a codified component of the company’s value proposition.

Table 2: Timeline of IREN’s Strategic Evolution and Public Statements (2023-2025)

| Date | Key Corporate Action | Key “Renewable” Statement/Claim | Source(s) |

| FY 2024 | Expansion of Bitcoin mining capacity to 10 EH/s. | “Procurement of RECs, consistent with our commitment to utilizing 100% renewable energy.” | ² |

| Aug 2024 | FY24 Results Conference Call. | (Implicit) Continued focus on renewable energy as a core part of the business model. | ³⁹ |

| Aug 2025 | Purchases 4.2k NVIDIA Blackwell GPUs. | (Implicit) Messaging around sustainable infrastructure for AI becomes more prominent. | ³⁸ |

| Aug 28, 2025 | Reports Full Year FY25 Results. | “About IREN… utilizing 100% renewable energy including through the purchase of RECs.” (Boilerplate) | ³ |

| Sep 22, 2025 | Doubles AI Cloud capacity to 23k GPUs. | (Implicit) The “green” claim underpins the attractiveness of its AI infrastructure offering. | ³⁸ |

| Oct 7, 2025 | Secures new multi-year AI Cloud contracts. | “About IREN… utilizing 100% renewable energy including through the purchase of RECs.” (Boilerplate) | ³⁸ |

| Oct 14, 2025 | Closes $1.0 Billion convertible notes offering. | “About IREN… utilizing 100% renewable energy including through the purchase of RECs.” (Boilerplate) | ³⁸ |

3.3 The Architects: Daniel and Will Roberts

The strategic direction of IREN is driven by its co-founders and co-CEOs, Daniel and Will Roberts.⁴⁰ Daniel Roberts’ background is particularly illuminating. He possesses 15 years of experience across finance, infrastructure, and the renewables industry.

Before co-founding IREN, he was a senior figure at Palisade Investment Partners, an Australian infrastructure fund. His responsibilities included the origination, development, and management of portfolio assets, including renewable energy projects.⁴¹

This deep, professional expertise suggests that IREN’s strategy of using unbundled RECs was not a naive or accidental choice. An executive with Roberts’ background would be intimately familiar with the spectrum of green power procurement options. These options range from high-impact direct Power Purchase Agreements (PPAs) to lower-cost, lower-impact unbundled RECs.

The decision to rely on unbundled RECs represents a sophisticated financial and risk-management calculation. It leverages a known and legally defensible market mechanism to achieve a specific commercial and marketing objective at minimal cost.

Section 4: The Additionality Deficit

Real Impact vs. Accounting Abstraction

The central critique of Iren Ltd.’s renewable energy strategy hinges on the concept of “additionality.” This section defines this critical principle. It also presents the substantial evidence that unbundled REC purchases—the mechanism IREN relies upon—fail this test.

This failure positions the practice not as a driver of decarbonization. Instead, it is a form of sophisticated greenwashing that exploits a loophole in corporate environmental accounting.

4.1 The Litmus Test of “Additionality”

In the context of climate and energy policy, “additionality” is a key principle.

“Additionality” means that an investment or action must lead to a real-world reduction in greenhouse gas emissions or an increase in renewable energy generation that would not have occurred otherwise.⁷

It is the litmus test for determining whether a “green” purchase has a tangible environmental benefit or is merely an accounting exercise. For a corporate clean energy claim to be meaningful, it must demonstrate that the company’s investment directly caused new renewable capacity to be added to the grid.⁷

4.2 The Case Against Unbundled RECs

Critics overwhelmingly agree that unbundled RECs fail the test of additionality.

When a company like IREN purchases a cheap, unbundled REC, the revenue typically flows to a renewable project that is already built and operating.⁷ The small, marginal income from the REC sale is rarely sufficient to be the deciding factor in financing and constructing a new, multi-million-dollar wind or solar farm.⁷

This practice allows companies to “report emission reductions that are not real”.⁴² It creates a significant and misleading gap between their claimed environmental performance and their actual physical impact.

A landmark 2022 study in Nature Climate Change quantified this discrepancy. It analyzed 115 companies. It found that while their reported emissions (using market-based instruments like RECs) fell by 31% between 2015 and 2019, their actual location-based emissions fell by only 10%.⁴² The authors concluded that the “widespread use of RECs raises doubt on companies’ apparent historic Paris-aligned emissions reductions”.⁴²

The primary driver for this low-impact instrument is its low cost. Unbundled RECs are often extremely cheap. They allow companies to make a “100% renewable” claim for a tiny fraction of the cost of direct investments in new renewable energy.⁷ This economic incentive has led to widespread criticism from environmental groups, who label the practice “greenwashing”.⁴³,⁴⁴

This dynamic represents a systemic arbitrage between two different carbon accounting methodologies: “location-based” and “market-based.”

- A company’s location-based emissions reflect the average carbon intensity of the regional grid from which it physically draws power.

- The market-based method allows a company to calculate its emissions based on the contractual instruments it purchases, such as RECs.⁴²

By purchasing enough RECs to match its consumption, IREN can legally report zero emissions under the market-based method. This creates an “integrity” problem, as noted by the Science Based Targets initiative (SBTi). The reported reduction on paper does not reflect a real-world change in atmospheric emissions.⁴²

4.3 Alternative Paths: Higher-Impact Procurement Models

Companies genuinely committed to decarbonizing their electricity consumption have several higher-impact procurement methods available. These options involve a more direct and substantial financial commitment but result in a more tangible environmental benefit.

Table 3: Comparison of Green Power Procurement Methods

| Procurement Method | Mechanism | Cost Profile | Impact on Additionality |

| Unbundled RECs | Purchase of renewable attributes separate from physical power. | Low | Very Low / Negligible: Rarely enables new construction.⁷ |

| Bundled RECs / Green Tariffs | Purchase of power and RECs together from a utility’s green energy program. | Moderate | Low to Moderate: Can support new projects, but often sources from existing assets. |

| Virtual PPA (VPPA) | A financial contract for power from a renewable project. The company receives the RECs but not the physical power. | Moderate to High | High: The long-term revenue certainty is often critical for financing new projects.⁷ |

| Direct PPA (from new build) | A long-term contract to purchase power and RECs directly from a specific, newly-built renewable facility. | High | Very High: The PPA is the direct enabler of the new project’s construction.⁷,⁴² |

| On-site Generation | Installing and operating renewable generation (e.g., solar panels) at the company’s own facility. | High | Very High: Directly adds new renewable capacity to the grid.⁴² |

By choosing the path of unbundled RECs, IREN has opted for the lowest-cost, lowest-impact option on this spectrum. While the company’s May 2025 monthly update includes an illustrative annual cost of $16 million for RECs in one scenario,⁴⁵ this expenditure is directed at purchasing accounting attributes, not at financing new renewable generation.

Section 5: A Broader Scheme

The Politicization and Mainstreaming of Digital Assets

While IREN’s strategy is perfectly adapted to the unique energy and political landscape of Texas, it does not exist in isolation. It is bolstered by a broader, national political movement aimed at legitimizing and integrating cryptocurrencies into the fabric of state governance and finance. An examination of legislative efforts in other states, such as Arizona, reveals a coordinated push to create a politically stable and de-risked environment for the digital asset industry.

5.1 Beyond Texas: The National Push for Crypto Legitimacy

The favorable political climate that IREN enjoys in Texas is mirrored in several other states, often driven along partisan lines. This movement frames the embrace of digital assets as a forward-looking policy that promotes innovation and economic growth. While Texas has become the epicenter for mining operations, states like Arizona are becoming legislative laboratories for the financial integration of cryptocurrencies.

5.2 Case Study: Arizona’s Bitcoin Reserve Bills

In 2025, the Arizona legislature advanced several significant bills to formally incorporate Bitcoin and other digital assets into the state’s financial framework. These initiatives are fundamentally important to the industry’s long-term viability.

- House Bill 2749: Signed into law by Governor Katie Hobbs, this bill creates a legal framework for the state to handle unclaimed cryptocurrency assets. It establishes a “Bitcoin and Digital Assets Reserve Fund” and allows the state’s custodian to hold these assets in their native form.⁴⁶,⁴⁷

- House Bill 2324: This bill addresses crypto assets seized by law enforcement through criminal forfeiture. It establishes procedures for securing these assets and creates a second “Bitcoin and Digital Assets Reserve Fund” to be administered by the State Treasurer.⁴⁸,⁴⁹

- Senate Bill 1025: This more ambitious bill would have permitted the state’s treasurer and public retirement systems to invest directly in cryptocurrencies. It was ultimately vetoed by Governor Hobbs, who stated that “Arizonans’ retirement funds are not the place for the state to try untested investments”.⁴⁷

These bills were largely sponsored by Republican legislators. They were framed as a way to position Arizona as a leader in financial innovation.⁵⁰

5.3 Connecting the Dots: Political Cover and Market Certainty

The legislative push in Arizona and the pro-mining stance in Texas are two facets of the same overarching political project. The goal is to embed the cryptocurrency industry within the state apparatus, thereby insulating it from federal regulatory risk and local opposition.

The industry faces significant headwinds, including price volatility, environmental criticism, and the threat of stringent federal oversight.⁵¹,⁵² To mitigate these risks, the industry has cultivated powerful allies at the state level.²¹,⁵⁰

In Texas, this alliance manifests as an “open for business” policy.¹² In Arizona, it manifests as legislation that bestows a new level of legitimacy upon digital assets.⁴⁷,⁴⁸ Both approaches serve the same ultimate purpose: to normalize the industry and make it more difficult to regulate in the future.

When a state’s own treasury holds and manages Bitcoin, it creates a powerful disincentive for that state to enact policies that might harm the asset’s value. This political mainstreaming provides a crucial layer of de-risking for the entire sector. Therefore, IREN’s ability to confidently invest hundreds of millions of dollars in Texas is implicitly supported by the broader political successes of the crypto lobby in states like Arizona.

Section 6: Conclusion & Recommendations

This investigation has systematically deconstructed Iren Ltd.’s claim to be “powered by 100% renewable energy.” It reveals a significant disconnect between the company’s market-based accounting and its physical reality within the Texas energy market.

The findings demonstrate that IREN’s strategy, while legally permissible, exploits a systemic flaw in environmental marketing. This concluding section synthesizes the report’s findings and offers actionable recommendations for key stakeholders.

6.1 Summary of Findings

The core findings of this report are as follows:

- A Claim of Accounting, Not Physics: Iren Ltd.’s “100% renewable energy” claim is substantiated through the purchase of unbundled RECs. This is an accounting mechanism, not a reflection of the physical power drawn from the gas-heavy ERCOT grid.¹,²,³,¹³

- A Failure of Additionality: The reliance on unbundled RECs is a low-impact strategy that fails the critical test of “additionality.” The practice is widely criticized by sustainability experts as a form of greenwashing.⁷,⁴²

- A Strategic Pivot: The prominence of IREN’s renewable claim directly correlates with its strategic pivot from Bitcoin mining to the more ESG-sensitive enterprise AI market. The claim is a crucial marketing tool.³,³⁸

- A Symbiotic Political-Economic System: IREN’s model is enabled by a unique ecosystem in Texas, characterized by a deregulated grid and a supportive political establishment. This is part of a broader political project to legitimize digital assets.²¹,⁴⁷

6.2 The Systemic Loophole

This investigation concludes that IREN’s behavior is not an isolated case. Rather, it is a rational and sophisticated corporate response to a fundamental flaw in the voluntary renewable energy market.

The ability to purchase cheap, unbundled RECs to make sweeping green claims is a well-known loophole. It prioritizes accounting convenience and marketing appeal over verifiable decarbonization. IREN, led by an executive team with deep expertise in energy finance, has skillfully exploited this system to its commercial advantage.⁴¹

The company’s actions underscore the urgent need for reform in how corporate green power claims are defined, regulated, and verified. The integrity of corporate climate action and the stability of critical energy grids hang in the balance. This situation demands an immediate shift from convenient accounting to verifiable, impactful decarbonization.

6.3 Recommendations for Due Diligence

Based on these findings, the following recommendations are offered to key stakeholders:

For Investors and ESG Analysts:

- Look Beyond Headlines: Treat all “100% renewable” claims with skepticism. Demand granular disclosure on the type of green power procurement method used.

- Prioritize Additionality: In ESG scoring, assign significantly higher value to companies that invest in direct Power Purchase Agreements (PPAs) with new renewable projects.

- Demand Dual Reporting: Encourage companies to report both their market-based and location-based Scope 2 emissions to provide a complete picture of their impact.

For Corporate Clients (AI Cloud Services):

- Incorporate Energy Sourcing into Procurement: Make transparent and high-impact energy procurement a key criterion when selecting data center and AI cloud service providers.

- Require Verifiable Impact: Insist that providers demonstrate how their energy procurement strategy is contributing to new renewable capacity on the specific grids where they operate.

For Regulators (SEC, PUCT):

- Enhance Disclosure Requirements: The SEC should consider new rules that mandate clearer, more standardized disclosure in corporate sustainability reports.

- Re-evaluate the REC Market’s Efficacy: The PUCT should conduct a thorough review of its REC program to assess whether it is promoting new renewable capacity or primarily facilitating greenwashing.

- Increase Grid Transparency: The PUCT and ERCOT should reverse the current trend toward secrecy regarding the energy consumption of large loads like crypto mines.⁵³,⁵⁴ Transparent, publicly available data is essential for public trust and accurate assessment.

Appendix: Glossary of Terms

- Additionality: The principle that a green investment or action must lead to a real-world increase in renewable energy generation (or a reduction in emissions) that would not have occurred otherwise. It is the key test for determining if a sustainability claim has a tangible environmental benefit.

- ERCOT (Electric Reliability Council of Texas): The independent system operator (ISO) that manages the electrical grid for approximately 90% of Texas. The ERCOT grid is largely isolated from the rest of the United States.

- Null Power: The physical electricity that remains after its associated Renewable Energy Certificate (REC) has been “unbundled” or sold separately. While the electrons are physically identical to any other electricity on the grid, they no longer carry the legal right to be claimed as “renewable.”

- Unbundled REC: A Renewable Energy Certificate that is sold separately from the physical megawatt-hour of electricity with which it was originally generated. This allows a company to purchase the “renewable” attribute of electricity without purchasing the physical power itself.

Works Cited

- IREN Limited. “iren.com.” 2025. https://iren.com/

- IREN Limited. “IREN Reports Full Year FY24 Results.” August 2024. https://irisenergy.gcs-web.com/news-releases/news-release-details/iren-reports-full-year-fy24-results/

- IREN Limited. “IREN Reports Full Year FY25 Results.” August 28, 2025. https://irisenergy.gcs-web.com/news-releases/news-release-details/iren-reports-full-year-fy25-results

- U.S. Environmental Protection Agency. “Renewable Energy Certificate Monetization.” 2024. https://www.epa.gov/greenpower/renewable-energy-certificate-monetization

- Constellation. “Renewable Energy Certificates (RECS) Explained.” 2023. https://www.constellation.com/energy-101/energy-innovation/renewable-energy-certificates-explained.html

- Resource Solutions. “Renewable Energy Certificates (RECs).” 2025. https://resource-solutions.org/learn/recs/

- S&P Global. “Problematic corporate purchases of clean energy credits threaten net-zero goals.” 2021. https://www.spglobal.com/sustainable1/en/insights/problematic-corporate-purchases-of-clean-energy-credits-threaten-net-zero-goals

- U.S. Environmental Protection Agency. “Unbundle Electricity and Renewable Energy Certificates.” 2023. https://www.epa.gov/lmop/unbundle-electricity-and-renewable-energy-certificates

- Wikipedia. “Electric Reliability Council of Texas.” 2025. https://en.wikipedia.org/wiki/Electric_Reliability_Council_of_Texas

- Texas Comptroller of Public Accounts. “ERCOT and the Texas Electric Grid.” 2023. https://comptroller.texas.gov/economy/economic-data/energy/2023/ercot.php

- ERCOT. “About ERCOT.” 2025. https://www.ercot.com/about

- Opportune. “Cryptocurrency In Texas: Why Bitcoin Mining Is Taking Off In The Lone Star State.” 2022. https://opportune.com/insights/news/cryptocurrency-in-texas-why-bitcoin-mining-is-taking-off-in-the-lone-star-state

- Low Carbon Power. “Electricity in Texas in 2024/2025.” 2025. https://lowcarbonpower.org/region/Texas

- ERCOT. “Renewable Energy Credit Program.” 2025. https://www.ercot.com/services/programs/rec

- U.S. Energy Information Administration. “Electricity demand in Texas and the mid-Atlantic is growing much faster than the rest of the U.S.” July 2025. https://www.eia.gov/todayinenergy/detail.php?id=65844

- The Texas Tribune. “Texas leaders worry that Bitcoin mines threaten to crash the state power grid.” July 10, 2024. https://www.texastribune.org/2024/07/10/texas-bitcoin-mine-noise-power-grid-cryptocurrency/

- ERCOT. “Renewable Energy Credit Program.” 2025. https://sa.ercot.com/rec/rec-program

- ERCOT. “Renewable Energy Credit.” 2025. https://www.ercot.com/services/programs

- Public Utility Commission of Texas. “Renewable Energy Credits (REC) Program.” 2025. https://www.puc.texas.gov/industry/electric/business/rec/

- ERCOT. “Nodal Protocols Section 14: State of Texas Renewable Energy Credit Trading Program.” December 31, 2020. https://www.ercot.com/files/docs/2020/12/31/14-090125_Nodal.docx

- The Texas Tribune. “Texas Republicans want to make the state the center of the cryptocurrency universe.” October 28, 2021. https://www.texastribune.org/2021/10/28/texas-republicans-blockchain-bitcoin/

- FOX 7 Austin. “A North Texas community will vote to form a city in an effort to quiet down a crypto mine.” 2024. https://www.fox7austin.com/news/north-texas-community-will-vote-form-city-effort-quiet-down-crypto-mine

- The Texas Tribune. “Texas Republicans want to make the state the center of the cryptocurrency universe.” October 28, 2021. https://www.texastribune.org/2021/10/28/texas-republicans-blockchain-bitcoin/

- Texas Standard. “Texas is becoming a Bitcoin mining capital. Can the grid handle it?” 2022. https://www.texasstandard.org/stories/texas-is-becoming-a-bitcoin-mining-capital-can-the-grid-handle-it/

- Business ABC. “IREN SpA.” 2025. https://businessabc.net/wiki/iren-spa

- Crypto News Australia. “Founders of Sydney-Headquartered IREN Cash Out $66M.” September 19, 2025. https://cryptonews.com.au/news/founders-of-sydney-headquartered-iren-cash-out-66m-as-firm-becomes-worlds-most-valuable-bitcoin-miner-130907/

- Tracxn. “IREN – About the company.” 2025. https://tracxn.com/d/companies/iren/__Dt671u7IzdyD11VhRwd7nhq1_8IuHYHPisDCuEtyZh4

- DCF Modeling. “IREN History, Mission & Ownership.” 2025. https://dcfmodeling.com/blogs/history/iren-history-mission-ownership

- EAA Partners Substack. “IREN Ltd.” 2024. https://eaapartners.substack.com/p/iren-ltd

- Alpha Spread. “IREN Investor Relations.” 2025. https://www.alphaspread.com/security/nasdaq/iren/investor-relations

- KPMG. “ESG in the crypto world.” 2022. https://kpmg.com/us/en/articles/2022/esg-crypto-climate-reporting-decentralized-finance.html

- Katten. “Crypto, Meet ESG. ESG, Meet Crypto.” July 15, 2021. https://katten.com/files/1127742_2021_07_15_frm_fmf_crypto_meet_esg_esg_meet_crypto_1.pdf

- PwC. “Bitcoin mining as an ESG strategy.” 2022. https://www.pwc.ch/en/insights/disclose/33/bitcoin-mining-as-an-esg-strategy.html

- Britannica. “Cryptocurrency’s environmental impact.” 2025. https://www.britannica.com/money/cryptocurrency-environmental-impact

- Investopedia. “How Does Bitcoin Mining Work?” 2024. https://www.investopedia.com/tech/how-does-bitcoin-mining-work/

- PLOS ONE. “The impact of investor attention and reversal on cryptocurrency returns.” 2025. https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0304377

- StocksToTrade. “IREN Limited (IREN) News.” October 14, 2025. https://stockstotrade.com/news/iren-limited-iren-news-2025_10_14/

- IREN Limited. “News Releases.” 2025. https://iren.com/investors/news

- IREN Limited. “Investors.” 2025. https://iren.com/investors

- IREN Limited. “Leadership Team.” 2025. https://iren.com/leadership-team

- Family Office Insights. “Daniel Roberts of Iris Energy.” 2021. https://familyofficeinsights.com/pir-qa/daniel-roberts-of-iris-energy/

- Greenhouse Gas Management Institute. “A new study charges that renewable energy credits are leading businesses to overestimate their carbon emissions cuts.” June 16, 2022. https://ghginstitute.org/2022/06/16/a-new-study-charges-that-renewable-energy-credits-are-leading-businesses-to-overestimate-their-carbon-emissions-cuts/

- C-Zero Markets. “Renewable Energy Certificates: Greenwashing or a valuable contribution to carbon reduction?” 2023. https://c-zeromarkets.com/renewable-energy-certificates-greenwashing-or-a-valuable-contribution-to-carbon-reduction/

- S&P Global. “Problematic corporate purchases of clean energy credits threaten net-zero goals.” 2021. https://www.spglobal.com/sustainable1/en/insights/problematic-corporate-purchases-of-clean-energy-credits-threaten-net-zero-goals

- IREN Limited. “IREN May 2025 Monthly Update.” 2025. https://irisenergy.gcs-web.com/news-releases/news-release-details/iren-may-2025-monthly-update/

- Arizona State Legislature. “House Bill 2749.” 2025. https://www.azleg.gov/legtext/57leg/1r/bills/hb2749h.pdf

- The Block. “Arizona becomes second US state to enact crypto reserve bill.” 2025. https://www.theblock.co/post/353552/arizona-becomes-second-us-state-to-enact-crypto-reserve-bill

- Arizona State Legislature. “HB2324 Senate Engrossed Summary.” May 6, 2025. https://www.azleg.gov/legtext/57leg/1R/summary/H.HB2324_050625_SENATEENGROSSED.DOCX.htm

- The Block. “Arizona lawmakers advance bill to establish crypto reserve using seized funds.” 2025. https://www.theblock.co/post/359532/arizona-lawmakers-advance-bill-to-establish-crypto-reserve-using-seized-funds

- YouTube. “Arizona could become first state with its own cryptocurrency reserve.” 2025. https://www.youtube.com/watch?v=hFTN3OGq57c

- Britannica. “What is crypto mining?” 2025. https://www.britannica.com/money/what-is-crypto-mining

- Americans for Financial Reform. “Crypto Legislation Must Address the Rampant Fraud at Crypto Kiosks.” 2023. https://ourfinancialsecurity.org/news/blog-crypto-legislation-must-address-the-rampant-fraud-at-crypto-kiosks/

- The Texas Tribune. “State utility commission sues Texas attorney general to avoid releasing crypto mining data.” August 11, 2025. https://www.texastribune.org/2025/08/11/texas-public-utility-commission-cryptocurrency-mining-power-lawsuit/

- The Texas Tribune. “State utility commission sues Texas attorney general to avoid releasing crypto mining data.” August 11, 2025. https://www.texastribune.org/2025/08/11/texas-public-utility-commission-cryptocurrency-mining-power-lawsuit/

Leave a Reply

You must be logged in to post a comment.