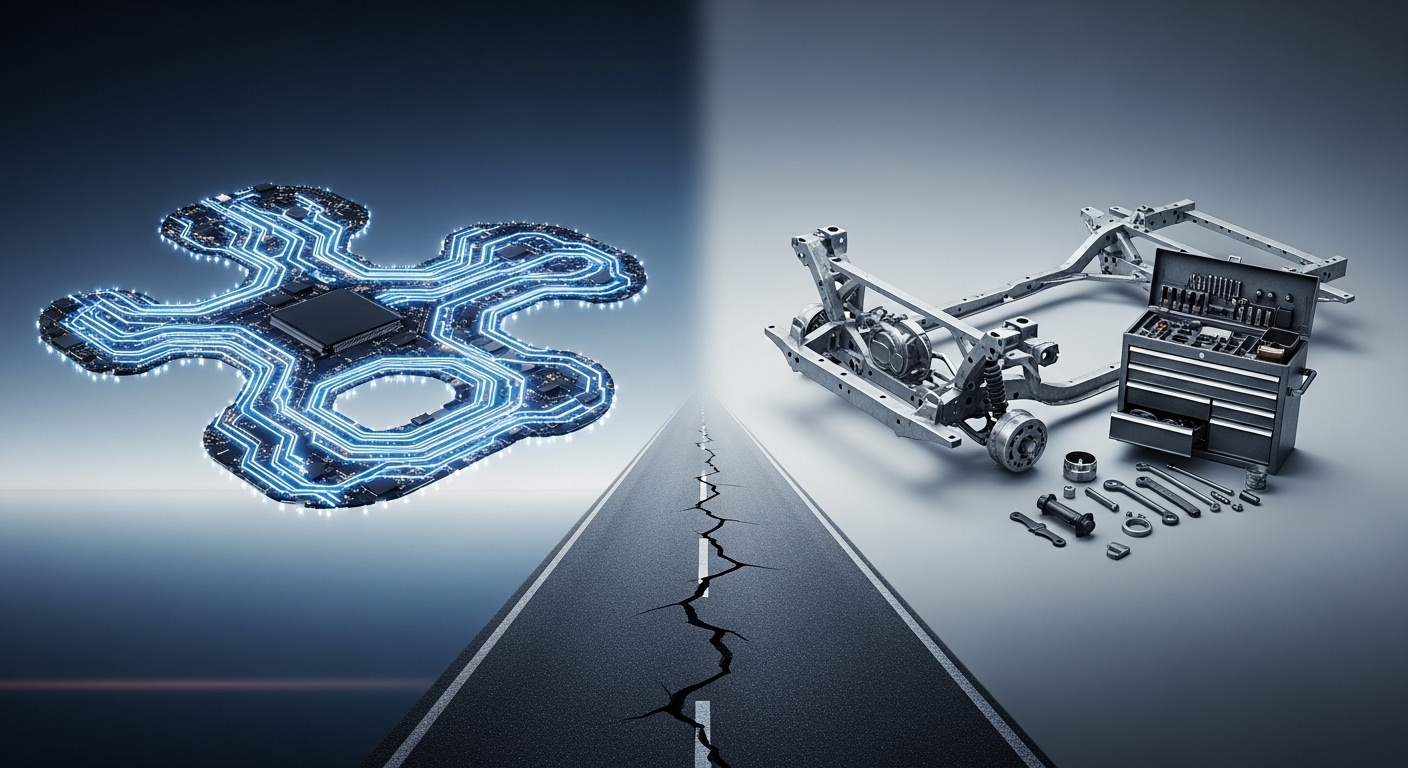

Section 1: Introduction: A Clash of Automotive Philosophies

The electric vehicle (EV) landscape is on the cusp of a seismic shift. This change is driven by Slate Auto, a well-funded startup from Troy, Michigan.¹ The company is backed by industry veterans and figures like Jeff Wilke, the former CEO of Amazon’s worldwide consumer business.¹

The company’s first product is the Slate Truck/SUV. Production is scheduled for late 2026.² Its arrival represents a profound ideological challenge to the modern vehicle’s definition—a definition largely written by Tesla. The impending competition is not merely about specifications. It is a clash of two diametrically opposed visions for personal transportation.

Thesis: This analysis argues that Slate and Tesla are not destined for a direct collision. Instead, they are carving out distinct market segments. Slate champions utilitarian simplicity against Tesla’s integrated technological ecosystem. The battle’s outcome will be shaped as much by consumer philosophy as by product capability.

The Incumbent: Tesla’s Vision

On one side stands Tesla, the undisputed pioneer. Tesla’s vision presents the vehicle as a sophisticated, vertically integrated technology platform. Its software continuously improves the hardware.³,⁴

The company meticulously curates the Tesla experience. It prioritizes blistering performance and the pursuit of automation through features like Full Self-Driving.⁵ A minimalist user interface, dominated by a central touchscreen, controls the vehicle.³,⁶ This vision offers high-tech convenience within a complete, manufacturer-controlled ecosystem.

The Challenger: Slate’s Vision

On the other side stands Slate, an anagram of Tesla and its philosophical inverse.¹ Slate positions its vehicle as a foundational utility tool. It is a “blank canvas” for the owner to complete.⁷,⁸

The company’s core promise encapsulates this philosophy:

“We Built It. You Make It.”¹,⁸

This motto signals a focus on empowerment, adaptability, and radical simplicity. The value of a Slate is derived not from pre-installed features, but from the potential of what the owner can create and modify.

The Market Hypothesis

For years, the auto industry has chased Tesla’s model. This has led to an arms race of larger screens and more complex software. Slate makes an audacious bet that a significant consumer segment is experiencing “tech fatigue.”

Slate wagers that these consumers desire a return to basics: a simple, durable, and affordable tool. The launch of the Slate Truck is therefore a real-world test of a powerful hypothesis. It will determine if many consumers prefer utilitarian simplicity and personal expression over the integrated, high-tech convenience that has defined the first EV era.

Section 2: The Challenger: Deconstructing the Slate Value Proposition

Slate’s strategy is not to out-perform Tesla on traditional metrics. Instead, it aims to redefine the terms of engagement. The company focuses on three pillars that the incumbent has largely ignored:

- Radical personalization

- Engineered affordability

- A new target demographic

Sub-section 2.1: The “Blank Slate” Doctrine: Empowerment Through Simplicity

The core of Slate’s identity is the promise of near-infinite personalization. This approach transforms the vehicle from a static purchase into a dynamic platform.

This begins with the vehicle’s modular architecture. It is built around more than 100 proprietary “Slate Attach Points”.⁹,¹⁰ These standardized connections accommodate an ecosystem of accessories like roof racks and storage solutions. Users can install these themselves with the help of “Slate U,” a hub of video tutorials.⁹,¹⁰

This philosophy extends to the vehicle’s appearance. Slate designed its vehicle to be “Wrapped, Not Painted”.⁹,¹⁰ Every Slate leaves the factory with the same unpainted, dent-resistant gray polypropylene-composite body panels.² Owners can then purchase wrap kits, starting at an estimated $500, to change the vehicle’s color and design at will.⁹,¹⁰

Perhaps the most dramatic expression of this modularity is the vehicle’s ability to transform its body style. The vehicle is engineered to convert from a two-seat pickup into a five-seat SUV and back again.¹,¹⁰ The optional SUV kit includes a hard top, a rear roll cage, curtain airbags, and a three-person rear bench seat. The owner can install this kit without professional assistance, allowing the vehicle to adapt to major life changes.²

Finally, Slate confronts technological obsolescence with its “Bring Your Own Tech” (BYOT) strategy. The Slate’s spartan interior features a simple mount for a smartphone or tablet instead of a large, integrated screen.⁹,¹¹ This slashes manufacturing costs while future-proofing the vehicle’s tech interface. The owner’s device, typically upgraded every few years, will always provide the latest software, ensuring the vehicle “will age gracefully”.⁹

Sub-section 2.2: Engineered for Affordability: A Bill of Materials Dissection

Slate’s promise of empowerment rests on a foundation of extreme affordability. The company targets a starting price under $28,000.¹,²,¹² This price is achieved through deliberate engineering choices aimed at radical simplification.

The powertrain is a prime example. The Slate uses a single rear-mounted electric motor producing a modest 201 horsepower.²,¹¹ This is sufficient for its role as a compact utility vehicle but avoids the cost of high-performance systems. This configuration also frees up space for a seven-cubic-foot front trunk, or “frunk”.²

The battery system is also carefully specified. Slate will offer two U.S.-built SK On battery packs:

- A standard-range 47 kWh pack for an estimated 150 miles.

- A long-range 75 kWh pack for a claimed 240 miles.²

By not forcing every customer to pay for a massive battery, Slate can achieve its disruptive price. However, this approach is sensitive to external factors. The initial sub-$20,000 price target relied on the $7,500 federal EV tax credit, which expires on September 30, 2025.¹³,¹⁴,¹⁵ The loss of this credit will make hitting that ultra-low price point more challenging.²,¹²

This philosophy of simplification extends everywhere. The use of unpainted composite body panels eliminates the need for a factory paint shop.² The interior is uncluttered, featuring essentials but forgoing expensive amenities.¹¹ Utility is also right-sized, with a 1,433-pound payload but a modest 1,000-pound towing capacity, positioning the Slate as a light-duty vehicle.²

Sub-section 2.3: Identifying the Slate Customer: The “Practical Radicals”

Slate’s value proposition targets a customer demographic largely overlooked by the current EV market. This group is a diverse coalition of “Practical Radicals” who prioritize utility, value, and self-expression. The potential market for such vehicles is substantial. The global micro EV market alone was valued at over $8 billion in 2023 and is projected to grow to $22.5 billion by 2032.¹⁶

Key segments of these “Practical Radicals” include:

- The Urban Utilitarian: For city dwellers, the Slate’s compact footprint and dual pickup/SUV functionality make it an ideal “one-car solution”.²

- The Financially Excluded: With average new vehicle prices near $50,000, many households are priced out of the new car market.¹⁷ Slate’s sub-$28,000 price point makes it a viable option for this enormous population.

- The Customization Culture: Slate appeals directly to individuals who see their possessions as extensions of their identity, from surfers and campers to artists and DJs.⁷

- Small Business Fleets: For small contractors and tradespeople, the Slate offers a low initial price, minimal operating costs, and easy customization for business needs.⁷,¹²

Section 3: The Incumbent: Pinpointing Tesla’s True Competitor

To understand the competitive landscape, we must identify Slate’s true Tesla counterpart. No single Tesla model is a direct competitor. Instead, Slate’s market entry challenges different aspects of Tesla’s lineup and its long-term promises. It is also important to note other players in the affordable truck space, like the Ford Maverick, which is Slate’s closest existing competitor in size and price.¹⁸,¹⁹,²⁰

Sub-section 3.1: The Cybertruck: A Study in Polar Opposition

At first glance, the Slate Truck’s rival might seem to be the Tesla Cybertruck. Both are electric pickups with unconventional designs. However, they are functional and philosophical antitheses.

The Cybertruck’s price begins around $72,235, roughly three times the target price of a Slate.⁵,²¹ The Cybertruck is a behemoth at nearly 19 feet long, featuring immense complexity with its stainless-steel exoskeleton.²,³,⁶,²² The Slate, by contrast, is a compact 14.5 feet long with a focus on mechanical simplicity.²

This chasm extends to performance. The Cybertruck is engineered for extreme capability, with supercar-like acceleration and an 11,000-pound towing capacity.⁵,²³ The Slate is designed for light-duty tasks with its 1,000-pound towing limit.² They do not share a target customer, price bracket, or use case.

Sub-section 3.2: The Model Y: The De Facto Mainstream Benchmark

The Tesla Model Y is a more relevant, albeit indirect, competitor. When equipped with its SUV kit, the Slate becomes a five-seat compact SUV. This places it in the same general category as the world’s best-selling EV.

The Model Y, starting around $41,630, represents the quintessential modern EV that Slate is rebelling against.²⁴,²⁵,²⁶ It offers everything the Slate omits: a large integrated touchscreen, a powerful tech ecosystem, strong performance, and seamless access to the Supercharger network.²⁴,²⁵,²⁷

The competition here is a clash of value propositions. A buyer can opt for the high-tech Model Y in the mid-$40,000s. Or, they can choose a five-seat Slate SUV in the low-to-mid $30,000s, embracing simplicity and a lower cost of entry.

Sub-section 3.3: The Specter of “Model 2”: Slate’s Preemptive Strike

The most critical rivalry involves a vehicle that does not yet exist: Tesla’s long-promised affordable car, often called the “Model 2.” For years, a core part of Tesla’s mission has been producing a vehicle starting around $25,000.²⁸ This has created a legion of customers waiting for an affordable entry into the Tesla ecosystem.

Slate’s entire strategy appears to be a preemptive strike on this territory. By targeting a sub-$28,000 price and a late 2026 launch, Slate is positioned to capture the exact market segment Tesla has claimed but failed to serve.¹,² It is attempting to define the affordable EV segment as “simple, modular, and customizable” before Tesla can.

This timing exploits a market vulnerability created by Tesla’s own promises. These promises have inadvertently generated a form of the “Osborne effect.”

The Osborne Effect: A phenomenon where customers defer purchasing current products while waiting for a superior, pre-announced future model.

Slate’s product is perfectly designed to intercept these waiting customers. It turns Tesla’s unfulfilled promise into its own strategic opportunity.

Section 4: Head-to-Head Analysis: Slate vs. Tesla’s Eventual Response

While Slate’s primary advantages lie in its philosophy and pricing, a direct comparison of its tangible attributes against Tesla’s offerings is essential to understand the trade-offs a potential customer will face. This analysis pits the Slate against the Tesla Model Y, its closest competitor in the compact SUV segment, and the Cybertruck, its philosophical opposite in the truck segment.

### Sub-section 4.1: Comparative Specification Matrix

To provide a clear, at-a-glance overview, the following table consolidates the key specifications and defining characteristics of the Slate Truck/SUV, the 2026 Tesla Model Y, and the 2025 Tesla Cybertruck. The data highlights the starkly different approaches each company has taken to vehicle design, performance, and utility.

| Feature Category | Slate Truck / SUV | Tesla Model Y (2026) | Tesla Cybertruck (2025) |

| Core Philosophy | Radically Simple, User-Defined Utility | Integrated Tech, Performance, & Ecosystem | Extreme Performance, Unconventional Design, Heavy Duty |

| Price (MSRP) | ~$27,500 (Std) / ~$30,500 (LR) est. | ~$41,630 (Std RWD) / ~$50,630 (LR AWD) | ~$72,235 (RWD) / ~$82,235 (AWD) |

| Drivetrain | Single-Motor RWD | RWD / Dual-Motor AWD | RWD / Dual-Motor AWD / Tri-Motor AWD |

| Performance (HP) | 201 hp | ~300 hp (Std) / ~397 hp (LR AWD) | ~600 hp (AWD) / ~834 hp (Cyberbeast) |

| Performance (0-60) | ~8.0 seconds | ~6.8s (Std) / ~4.6s (LR AWD) | ~6.5s (RWD) / ~3.9s (AWD) |

| Battery (usable) | ~$47$ kWh (Std) / ~$75$ kWh (LR) | ~$69$ kWh (Std) / ~$80$ kWh (LR) | ~$123$ kWh |

| Range (EPA est.) | ~150 miles (Std) / ~240 miles (LR) | ~321 miles (Std) / ~327 miles (LR AWD) | ~250 miles (RWD) / ~325 miles (AWD) |

| DC Fast Charging | 120 kW peak | ~225-250 kW peak | 250 kW peak |

| Dimensions (L x W) | 174.6″ x (TBD) | 188.6″ x 78.0″ (mirrors folded) | 223.7″ x 86.6″ (mirrors folded) |

| Weight (curb) | ~3,700 lbs (Std) / ~4,000 lbs (LR) | ~4,061 lbs (Std) / ~4,396 lbs (LR AWD) | ~6,634 lbs (AWD) |

| Payload Capacity | ~1,433 lbs (Std) / ~1,131 lbs (LR) | N/A (SUV) | ~2,500 lbs |

| Towing Capacity | 1,000 lbs | 3,500 lbs (with tow package) | 7,500 lbs (RWD) / 11,000 lbs (AWD) |

| Seating | 2 (Truck) / 5 (SUV Kit) | 5 (7 optional) | 5 |

| Cargo Volume | 5-ft bed + 7 cu.ft. frunk | 76 cu.ft. (total) | 6-ft bed (120.7 cu.ft. total lockable) |

| Tech Integration | Bring-Your-Own-Device (BYOD) | Fully Integrated 15.4″ Touchscreen, Tesla OS | Fully Integrated 18.5″ Touchscreen, Tesla OS |

| Customization Model | Post-purchase via wraps, 100+ attach points, DIY | Point-of-sale options (color, wheels), software unlocks | Point-of-sale options, limited aftermarket |

Data compiled from sources.²⁻⁶,¹¹,²²,²³,²⁴,²⁷,²⁹,³⁰

Sub-section 4.2: The Battle of Price and Value

Slate’s most significant advantage is its disruptive price point.²,¹² However, value extends beyond the sticker price. Slate’s simple design suggests potential advantages in total cost of ownership. Its powertrain has fewer complex components. Its unpainted body panels are likely far cheaper to repair than a Tesla’s, potentially leading to lower insurance and repair costs.²

The value proposition also differs in its timing. Tesla’s value is front-loaded; the customer pays a premium for a fully integrated suite of technology. Slate’s value is modular. A customer can buy the base truck and later purchase an SUV kit or other accessories as their needs and budget evolve.⁹,¹⁰ This financial flexibility is a powerful form of value.

Sub-section 4.3: The User Experience Divide: Empowerment vs. Ecosystem

The day-to-day experience of owning a Slate versus a Tesla will be profoundly different. Owning a Slate is designed to be a hands-on, creative experience. The “Slate U” content hub fosters a “maker” culture.⁹,¹⁰ The reliance on one’s own device for infotainment means the user interface is familiar, but it also introduces potential friction points that integrated systems avoid.

The Tesla ownership experience is defined by its effortlessness and deep integration into a “walled garden” ecosystem. The vehicle’s operating system manages everything through a single, minimalist interface.⁵,²⁵ The entire experience is designed to be frictionless. The trade-off for this convenience is a lack of control. The owner is a user within Tesla’s ecosystem, not a creator with agency over the platform.

Sub-section 4.4: The Infrastructure Moat: Supercharging

In long-distance EV travel, Tesla possesses an overwhelming advantage: the Supercharger network.⁴,⁹ Slate will rely on the public Combined Charging System (CCS) network. This network is notoriously fragmented and inconsistent.

Slate’s own technical limitations compound this issue. Its peak DC fast-charging rate is 120 kW, and it will initially lack on-route battery preconditioning.²⁹ This means long-distance travel in a Slate will be slower and potentially more frustrating. For buyers who frequently take road trips, the Supercharger network could be a decisive factor.

Section 5: The Strategic Battlefield: Projecting Tesla’s Counter-Moves

The entrance of a disruptive, low-cost competitor like Slate will inevitably provoke a strategic response from Tesla. Given its history of aggressive tactics, Tesla has several potential pathways to counter the threat.

Scenario 1: The “Model 2” Acceleration & De-Contenting

Tesla’s most direct response would be to accelerate its own affordable vehicle platform. A more immediate tactic would be to further de-content its existing Model 3 and Model Y. Tesla has already done this with its “Standard” range models, which use smaller batteries and remove premium features.²⁴,³⁰

To counter Slate, Tesla could take this to an extreme. It could introduce a new base Model Y with a software-limited battery, slower acceleration, and fewer standard features. Such a vehicle could start in the mid-to-high $30,000s, significantly narrowing the price gap with a five-seat Slate SUV.

Scenario 2: The Price War Offensive

Tesla is one of the few automakers with the margins to successfully wage a price war. A highly probable response would be a series of strategic price cuts on the entry-level Model Y.

The goal would be to erode Slate’s primary advantage: its price. If Tesla could reduce the price difference to $5,000-$7,000, the value proposition for Slate would be severely compromised. Many customers would likely find the premium for Tesla’s superior range, performance, and Supercharger network to be a justifiable expense.

Scenario 3: The Indifference Doctrine & Margin Focus

Alternatively, Tesla might conclude that the sub-$30,000 market is a strategic distraction. This segment is characterized by high volume but thin profit margins. Tesla could choose to cede this ground and instead double down on areas where its true advantages lie: high-performance vehicles, battery technology, and autonomous driving software.

In this scenario, Tesla would view Slate not as a direct competitor, but as a niche player. This is plausible if Tesla’s leadership believes future profitability lies in high-margin software and autonomous services, not low-cost unit sales.

This leads to Tesla’s most potent and likely response: an asymmetrical one. Rather than competing on hardware simplicity, Tesla can leverage its strength in software. It could introduce a vehicle at a competitive base price but with key features software-locked. These features could be available only through post-purchase unlocks or subscriptions. This strategy reframes the competitive question and creates a battlefield where Slate, with its BYOT philosophy, is not equipped to fight.

Section 6: Final Verdict: A Divergence of Markets, Not a Direct Collision

Who is going to win the battle? The most accurate answer is that Slate and Tesla are not destined for a head-on collision. Instead, they are poised to win different victories by proving the viability of their opposing philosophies in a diversifying EV market. This is not a zero-sum game. It is the beginning of a market segmentation that will ultimately benefit the consumer.

Slate’s Path to Victory

For Slate, victory is not defined by outselling the Model Y. Slate “wins” by proving that a substantial, profitable market exists for simple, affordable, and customizable EVs. Its success will be measured by its ability to achieve production targets, maintain its price point, and cultivate a loyal community.

A victorious Slate becomes the “Subaru of EVs” or the “Jeep of the city.” It would be a beloved brand with a devoted following that feels alienated by the complexity and high cost of the mainstream EV market.

Tesla’s Enduring Dominance

For Tesla, “winning” means continuing to execute its long-term vision while maintaining dominance in the premium EV sectors. Slate does not pose an existential threat. Tesla’s immense advantages in brand recognition, manufacturing scale, software integration, and the Supercharger network create a powerful competitive moat.

Tesla’s victory lies in continuing to drive the industry’s technological progress. It can capture the lion’s share of global EV profits while ceding the lowest-margin segment of the market to new entrants.

Conclusion: The Market is the Ultimate Winner

The emergence of a challenger like Slate is not a sign of weakness for Tesla. It is a sign of health and maturation for the entire electric vehicle market. For the first decade of the modern EV era, a single paradigm defined the market. Slate’s arrival marks the beginning of a necessary diversification.

This is not a direct collision but a divergence. Slate is charting a new course into the territory of the truly affordable, utilitarian EV. Tesla will continue to dominate the established highways of performance and technology. The true outcome of this “battle” will be a richer, more varied landscape of choices for consumers. This represents a victory for everyone invested in the future of electric mobility.

Works Cited

- “Slate Auto.” Wikipedia. Accessed October 19, 2025. https://en.wikipedia.org/wiki/Slate_Auto

- Gluckman, David. “2027 Slate Truck EV.” Car and Driver. June 24, 2025. https://www.caranddriver.com/features/a65971207/slate-truck/

- “Design Your Cybertruck.” Tesla. Accessed October 19, 2025. https://www.tesla.com/cybertruck/design

- “Model X – Luxury Electric SUV.” Tesla. Accessed October 19, 2025. https://www.tesla.com/modelx

- Pajo, Greg. “2025 Tesla Cybertruck Review, Pricing, and Specs.” Car and Driver. Accessed October 19, 2025. https://www.caranddriver.com/tesla/cybertruck

- “Cybertruck – Electric Utility Truck.” Tesla. Accessed October 19, 2025. https://www.tesla.com/cybertruck

- “The Blank Slate.” Slate Auto. Accessed October 19, 2025. https://www.slate.auto/

- “Slate – We Built It. You Make It.” YouTube, uploaded by Slate Auto. April 24, 2025. https://www.youtube.com/watch?v=mxMd3SNEKCA

- “Personalization.” Slate Auto. Accessed October 19, 2025. https://www.slate.auto/en/personalization

- “Things Change. A Slate Changes, Too.” Slate Auto. Accessed October 19, 2025. https://www.slate.auto/en/personalization

- Irwin, Austin. “Slate Electric Mini Truck Debut: First Look.” Edmunds. April 24, 2025. https://www.edmunds.com/car-news/slate-electric-mini-truck-debut-first-look.html

- “Is This $20k EV the Future of Trucks?” YouTube, uploaded by Your Car Friend. April 24, 2025. https://www.youtube.com/watch?v=2cUI2pZlKIo

- “The Ins and Outs of Electric Vehicle Tax Credits.” Edmunds. July 5, 2025. https://www.edmunds.com/fuel-economy/the-ins-and-outs-of-electric-vehicle-tax-credits.html

- Lambert, Fred. “EV Tax Credit 2024/2025: How it works, what cars qualify, and how to get it.” Electrek. October 9, 2025. https://electrek.co/ev-tax-credit-rebate-states-electric-vehicles/

- “Honda EV Tax Credit Changes.” Honda North. Accessed October 19, 2025. https://www.hondanorth.com/ev-tax-credit-changes.htm

- “Micro Electric Vehicle (EV) Market.” Fortune Business Insights. Accessed October 19, 2025. https://www.fortunebusinessinsights.com/micro-electric-vehicles-ev-market-103474

- “After the Credits: How EV Adoption Advances When Incentives Fade.” Cox Automotive Inc. October 15, 2025. https://www.coxautoinc.com/insights-hub/after-the-credits-how-ev-adoption-advances-when-incentives-fade/

- Rivers, Stephen. “How Does Slate’s New $28k EV Truck Stack Up Against The Ford Maverick?” Carscoops. April 25, 2025. https://www.carscoops.com/2025/04/slate-ev-versus-ford-maverick/

- Gluckman, David. “2027 Slate Truck EV vs. 2025 Ford Maverick: How They’ll Compare.” Car and Driver. June 24, 2025. https://www.caranddriver.com/features/a65132734/2027-slate-truck-ev-vs-2025-ford-maverick-specs-compared/

- “2027 Slate Truck EV vs. 2025 Ford Maverick.” Car and Driver. June 24, 2025. https://www.caranddriver.com/features/a65132734/2027-slate-truck-ev-vs-2025-ford-maverick-specs-compared/#:~:text=Truck%20EV%20vs.-,2025%20Ford%20Maverick%3A%20How%20They’ll%20Compare,will%20be%20its%20closest%20competition.&text=As%20big%20trucks%20continue%20to,spectrum%20for%20manageably%20sized%20haulers.

- “2024 Tesla Cybertruck Range, Specs And Pricing Overview.” InsideEVs. January 29, 2024. https://insideevs.com/news/706361/2024-tesla-cybertruck-range-specs-pricing-overview/

- “Dimensions, Weights, and Cargo Capacity.” Tesla Cybertruck Owner’s Manual. Accessed October 19, 2025. https://www.tesla.com/ownersmanual/cybertruck/en_us/GUID-12A976DD-EB60-431B-AFF1-5A37E95006DB.html

- “Tesla Cybertruck: Full Details and Pricing.” GreenCars. Accessed October 19, 2025. https://www.greencars.com/expert-insights/tesla-cybertruck-full-details-and-pricing

- Simari, Michael. “2026 Tesla Model Y Review, Pricing, and Specs.” Car and Driver. October 6, 2025. https://www.caranddriver.com/tesla/model-y

- Buglewicz, Keith. “2026 Tesla Model Y Prices, Reviews, and Pictures.” Edmunds. October 7, 2025. https://www.edmunds.com/tesla/model-y/

- “2026 Tesla Model Y Standard: This Is It.” InsideEVs. October 7, 2025. https://insideevs.com/news/774980/2026-tesla-model-y-standard-affordable-ev/

- “Model Y – Electric Midsize SUV.” Tesla. Accessed October 19, 2025. https://www.tesla.com/modely

- “This $25,000 Tesla KILLER is HERE! Slate EV First Look.” YouTube, uploaded by RyanShaw. April 24, 2025. https://www.youtube.com/watch?v=1T3ye2pZlKI

- “The Slate Is A $20k EV That Can Be A Truck Or SUV! First Look At This Blank Slate.” YouTube, uploaded by Out of Spec Reviews. April 24, 2025. https://www.youtube.com/watch?v=out-F6n91qs

- “New ‘affordable’ Model Y & 3.” Reddit. October 7, 2025. https://www.reddit.com/r/TeslaLounge/comments/1o0mrso/new_affordable_model_y_3/

Leave a Reply

You must be logged in to post a comment.