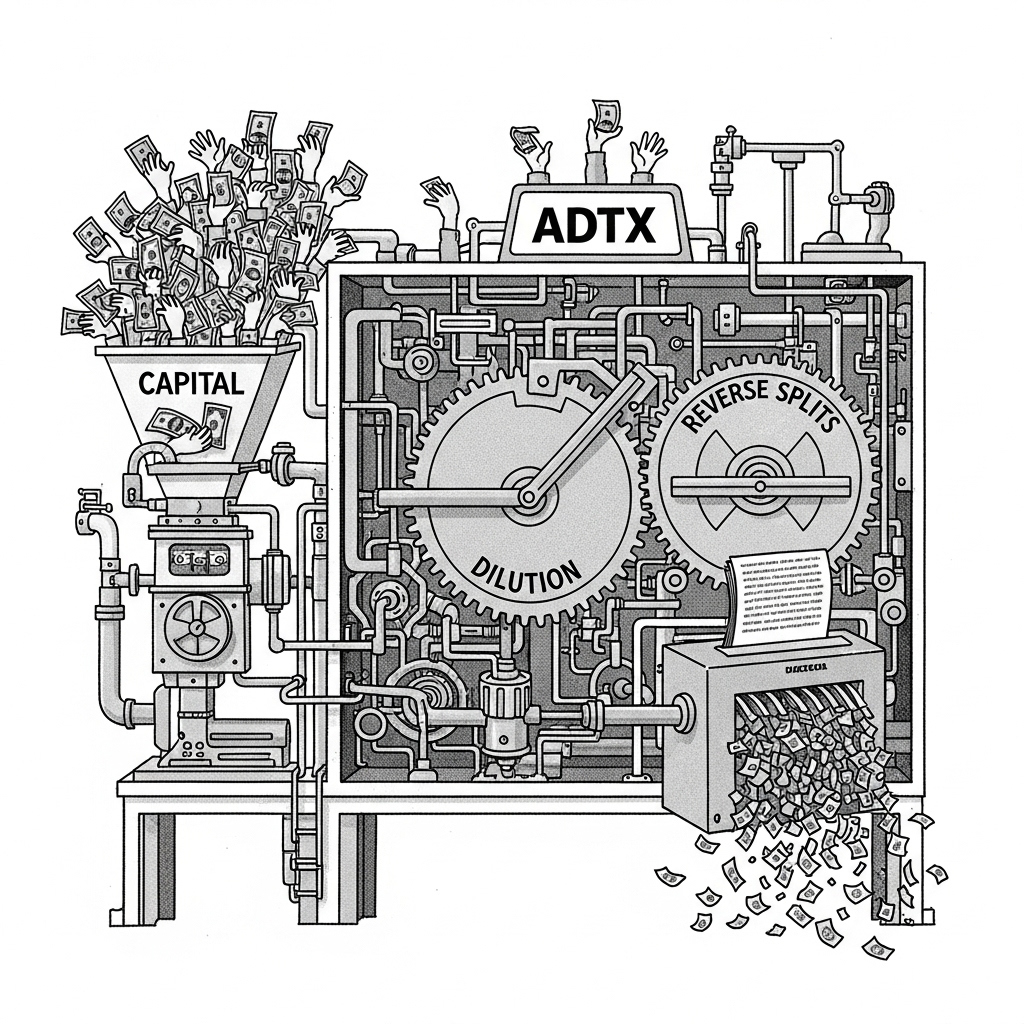

For investors in Aditxt, Inc. (NASDAQ: ADTX), the journey has been a brutal lesson in value destruction. This report deconstructs the anatomy of a company that has mastered the art of raising capital while systematically erasing it. Aditxt operates not as a viable biotechnology enterprise but as a perpetual financing vehicle. This vehicle is fueled by relentless shareholder dilution.

Through an analysis of its financial history, questionable strategic gambits, and a cycle of reverse stock splits, a clear thesis emerges. Aditxt’s business model is structurally engineered to benefit its operators at the direct expense of its public shareholders.

I. Executive Summary

This report provides an in-depth investigative analysis of Aditxt, Inc. (NASDAQ: ADTX). Aditxt is a biotechnology company that has attracted significant investor scrutiny. Since its 2017 inception and 2020 Initial Public Offering (IPO), Aditxt has operated as an “innovation platform.”¹ It pursues a strategy of acquiring and developing a disparate portfolio of preclinical and early-stage health technologies.² This investigation reveals a critical flaw: this strategy relies on a financial model of perpetual shareholder dilution. This model has led to a catastrophic destruction of market value.

The company has never achieved profitability. It consistently posts negligible revenues against multi-million-dollar net losses and a high cash burn rate. To fund these operations, Aditxt has raised over $109 million from capital markets since 2020.³ This relentless issuance of new shares has systematically eroded the stock’s value. The falling stock price has triggered multiple non-compliance notices from the Nasdaq exchange.

In response, the company executed a series of aggressive reverse stock splits. These included 1-for-50, 1-for-40, and 1-for-250 splits.⁴, ⁵, ⁶ These actions allowed Aditxt to procedurally maintain its Nasdaq listing. However, their cumulative effect has been devastating for long-term shareholders. The company’s market capitalization has collapsed to a fraction of the capital it raised.

A pivotal event was its audacious 2023 bid for the assets of the bankrupt diagnostic firm Lucira Health. Aditxt made the bid through its newly formed subsidiary, Pearsanta, Inc. The bid, valued at up to $35.9 million, was ultimately rejected.⁷ The court favored a competing offer from pharmaceutical giant Pfizer.⁸ The proceedings in the U.S. Bankruptcy Court for the District of Delaware exposed profound skepticism. The market and creditors doubted Aditxt’s financial capacity to fund such a transaction.⁹ This public failure validated the financial weaknesses long evident in the company’s public filings.

Aditxt’s executive team has backgrounds in finance and serial entrepreneurship. Their actions appear to prioritize financial engineering and narrative-driven capital raises. This focus comes at the expense of successfully commercializing a focused product. The company’s continued presence on the Nasdaq is not an endorsement of its business model. Instead, it is a function of a rule-based system that permits mechanisms like reverse splits to maintain listing requirements.

This analysis synthesizes financial data, SEC filings, and court documents. It deconstructs the operational and financial history of Aditxt. The result is a clear, evidence-based explanation for the concerns that have defined its public market existence.

II. Aditxt: The Anatomy of an “Innovation Platform”

To understand Aditxt’s trajectory, one must first dissect its corporate identity and strategic vision. The company presents itself not as a traditional biotechnology firm with a clear therapeutic focus. Instead, it calls itself a “social innovation platform.”¹⁰ This platform is designed to acquire, develop, and monetize a wide array of health-related technologies.¹, ² This model, driven by its leadership’s deal-making background, has defined its history and financial outcomes.

A. Corporate Genesis and Leadership: The Who and Why

Aditxt, Inc. was incorporated in Delaware on September 28, 2017.¹¹, ¹² Its stated mission is to discover, develop, and deploy innovations to address pressing health challenges, with a core focus on the immune system.¹, ¹³

The company’s headquarters has been a moving target. Initial filings listed locations in California, including Loma Linda and Mountain View.¹¹, ¹⁴ On July 7, 2021, the company relocated its principal executive offices to Richmond, Virginia. Richmond is home to its CLIA-certified immune monitoring center.¹⁵

Aditxt’s strategic direction is inextricably linked to its co-founders’ professional histories.

The Architect: CEO Amro Albanna

Co-founder, Chairman, and CEO Amro Albanna is the primary architect of Aditxt’s M&A-driven strategy. He describes himself as a “serial innovation entrepreneur” with over 25 years of experience.¹⁶, ¹⁷ His biography states he has founded eight startups in a wide range of industries, including¹⁶, ¹⁸:

- Enterprise software

- Research incubation

- GPS and wireless technology

- Nano sensors

- Consumer health

- Biotech

A key aspect of his background is his experience leading multiple M&A and going-public transactions on various exchanges.¹⁷ This history of deal-making, rather than scientific discovery, appears to be the dominant influence on Aditxt’s corporate playbook. SEC filings also identify him as an owner in at least one other public entity, Shonghoya Intl Group Inc (SNHO).¹⁹

The Scientist: CIO Shahrokh Shabahang

Co-founder and Chief Innovation Officer Dr. Shahrokh Shabahang, MS, PhD, provides the company’s scientific foundation. With over two decades of experience, his expertise lies in microbiology and immunology.¹⁶, ²⁰ Dr. Shabahang has a deep academic affiliation with Loma Linda University, where he has been a prolific researcher.²¹, ²² His work is central to Aditxt’s lead therapeutic platform, Apoptotic DNA Immunotherapy™ (ADI™).¹⁶, ²³ This technology’s origins trace back to research at Loma Linda University in the late 1990s, initially funded by a U.S. Department of Defense grant.¹¹, ¹²

The leadership team and board are populated with individuals who possess impressive credentials on paper. However, this collection of high-caliber talent has failed to translate into operational success or shareholder value.²⁴, ²⁵ This suggests the fundamental business model itself may be flawed.

B. A Sprawling Portfolio: A Strategy of Diversification

Aditxt’s business model is to acquire and develop a diverse portfolio of assets. It then aims to monetize them through mergers, sales, licenses, or spin-offs.¹, ²⁶ This has resulted in a sprawling and unfocused collection of programs. Many are preclinical and years away from potential revenue generation.

For a micro-cap company with extremely limited financial resources, this diversification represents a significant diffusion of capital and attention. The portfolio includes:

- Adimune™: The flagship therapeutic program, focused on “retraining” the immune system. Its lead product, ADI-100, is being explored for indications like psoriasis, Type 1 diabetes, and Stiff Person Syndrome.¹, ²

- Pearsanta™: The precision health and diagnostics arm. This subsidiary commercializes the AditxtScore™ platform for immune system profiling and focuses on early cancer detection with its Mitomic® Technology.²⁷, ²⁸, ²⁹

- Adivue™: A program centered on neurological diagnostics, including EEG brain monitoring technologies like NeuroCap and NeuroEEG.¹, ²

- Proposed Acquisitions: Aditxt has pursued aggressive M&A, entering agreements with Evofem Biosciences (reproductive health) and Appili Therapeutics (infectious diseases).¹, ³⁰, ³¹ However, closing these deals is contingent on Aditxt raising sufficient capital—a significant hurdle.³⁰, ³¹ Evofem’s shareholders ultimately rejected the merger.³², ³³

This “innovation platform” model creates a compelling narrative for fundraising. However, it also obscures the lack of tangible progress in any single area. By spreading its limited resources across at least five distinct health verticals, the company ensures no single program can be adequately funded to reach a value-creating milestone.

III. The Financials of a Perpetual Startup

An examination of Aditxt’s financial history reveals a company operating as a perpetual startup. It is entirely dependent on capital markets for survival. The chasm between its expenditures and revenues is the central feature of its financial story. This reality has directly led to the systematic erosion of shareholder value.

A. A History of Unprofitability

Since its inception, Aditxt has failed to achieve profitability or generate significant revenue. The company’s SEC filings paint a consistent and grim picture.

For the trailing twelve months (TTM), Aditxt reported revenue of just $12,050 against a staggering net loss of $31.04 million.³⁴ This is not an anomaly but a long-term trend. The company’s 10-Q for the nine months ended September 30, 2023, showed revenue of $563,879 and a net loss of $21.58 million.³⁵ The company also reported zero revenue for 2018 and 2019 while accumulating net losses of over $5 million each year.¹¹, ¹²

This chronic unprofitability is coupled with a precarious cash position. The company’s cash reserves have steadily dwindled, falling from $10.5 million at the end of 2020 to a critically low $97,000 by the end of 2023.³⁶ This necessitates a constant cycle of capital infusions to maintain operations.

The table below summarizes Aditxt’s historical financial performance.

Table 1: Aditxt, Inc. Historical Financial Performance Summary (2019-2023)

| Fiscal Year | Total Revenue (USD) | Net Income (Loss) (USD) | Operating Cash Flow (USD) | Financing Cash Flow (USD) | End of Year Cash (USD) |

| 2023 | $563,879 (9 mos.) | $(21,579,795) (9 mos.) | $(18,600,000)$ | $15,900,000$ | $97,000$ |

| 2022 | $748,119 (9 mos.) | $(19,466,710) (9 mos.) | $(22,400,000)$ | $17,500,000$ | $2,800,000$ |

| 2021 | Not Available | Not Available | $(22,300,000)$ | $36,000,000$ | $7,900,000$ |

| 2020 | $0$ | $(5,827,728)$ | $(7,200,000)$ | $17,900,000$ | $10,500,000$ |

| 2019 | $0$ | $(5,689,237)$ | $(464,000)$ | $353,000$ | Not Available |

| Note: 2023 and 2022 figures are for the nine months ended September 30. Other data is for full fiscal years. | |||||

| Sources: ¹¹, ¹², ³⁵, ³⁶ |

The data clearly shows a fundamentally unsustainable business model. The company’s primary commercial offering, AditxtScore™, has failed to gain meaningful market traction.³⁴, ³⁷ Aditxt is not a struggling business on the path to profitability. It is a non-business entity funded almost exclusively by stock sales.

B. The Dilution Engine

To cover its substantial operating losses, Aditxt has consistently turned to the capital markets. It raises funds by selling equity in the form of common stock, preferred stock, and warrants. This process, known as dilution, increases the total number of shares outstanding. This, in turn, reduces the ownership percentage of existing shareholders.

The company’s cash flow statements provide a clear record of this “dilution engine.” Since its 2020 IPO, Aditxt has raised a tremendous amount of capital³:

- 2020: $17.9 million

- 2021: $36.0 million

- 2022: $17.5 million

- 2023: $15.9 million

- 2024 (projected/to date): $22.5 million

This amounts to a total of $109.8 million raised from financing activities since the beginning of 2020.³ This capital has been acquired through a relentless series of public offerings and private placements.³⁸, ³⁹

C. The Reverse Split Treadmill

The direct consequence of issuing millions of new shares is a collapse in the per-share stock price. When the price falls below Nasdaq’s $1.00 minimum bid price requirement, the company receives a delisting notice.⁴⁰ To cure this deficiency, Aditxt has repeatedly employed reverse stock splits. A reverse split consolidates existing shares into fewer, more highly-priced shares. This action artificially boosts the stock price without creating any underlying business value.

Aditxt’s history is marked by these procedural maneuvers. Each one resets the stage for another round of dilution. Documented reverse splits include:

- 1-for-50: Effective September 14, 2022.⁴

- 1-for-40: Effective October 2, 2024.⁵

- 1-for-250: Effective March 17, 2025.⁶, ⁴¹, ⁴²

The cumulative impact of these splits is staggering. An investor holding 500,000 shares would see their holdings reduced to just one share. This demonstrates how a significant stake can be mathematically wiped out. This cycle—dilution, price collapse, reverse split, and more dilution—is the central process driving the destruction of shareholder value at Aditxt.

Table 2: Chronology of Aditxt, Inc. Reverse Stock Splits

| Effective Date | Event | Ratio | Stated Purpose |

| September 14, 2022 | Reverse Stock Split | 1-for-50 | To address Nasdaq minimum bid price requirement. |

| October 2, 2024 | Reverse Stock Split | 1-for-40 | To address Nasdaq minimum bid price requirement. |

| March 17, 2025 | Reverse Stock Split | 1-for-250 | To bring the Company into compliance with Nasdaq’s minimum bid price requirement. |

| Sources: ⁴, ⁵, ⁶ |

D. Quantifying Value Destruction

The ultimate measure of a public company’s performance is its return to shareholders. In Aditxt’s case, the outcome has been an almost total loss of invested capital. A simple comparison illustrates this point:

- Total Capital Raised (2020-2024): $109.8 million³

- Market Capitalization (late 2025): Approximately $2.37 million⁴³

This disparity reveals that for every dollar invested, approximately 98 cents of market value has been erased. The stock’s split-adjusted price has fallen from a high of $1,000,000 in June 2020 to well under a dollar today.⁴⁴ During the 2022 inflation shock alone, the stock fell 100.0%.⁴⁵

IV. The Lucira Gambit: A Bid Exposes Financial Weakness

In early 2023, Aditxt undertook its most audacious move: an attempt to acquire the assets of the bankrupt diagnostic company, Lucira Health. This episode, executed through its new subsidiary Pearsanta, was not merely a failed M&A transaction. It was a public spectacle that placed Aditxt’s questionable financial capacity under the intense scrutiny of creditors, rivals, and a federal bankruptcy judge.

A. The Birth of Pearsanta

On February 14, 2023, Aditxt announced the formation of Pearsanta, Inc., a wholly-owned subsidiary.²⁷ The stated purpose was to accelerate the growth of the AditxtScore™ program and pursue strategic transactions.²⁷, ⁴⁶ Pearsanta was established as the company’s precision medicine and cancer detection arm.²⁷, ²⁸, ²⁹

The timing was critical. Just eight days later, on February 22, 2023, Lucira Health filed for Chapter 11 bankruptcy.⁴⁷, ⁴⁸ This proximity strongly suggests Pearsanta was formed, at least in part, as a special purpose vehicle to bid for Lucira’s assets.

B. The Lucira Health Bankruptcy Auction

The bankruptcy proceedings for Lucira Health (Case # 23-10242) took place in the U.S. Bankruptcy Court for the District of Delaware. The Honorable Mary F. Walrath presided.⁴⁹, ⁵⁰, ⁵¹

Lucira was a company of significant interest. It had received the first FDA Emergency Use Authorization (EUA) for an at-home rapid COVID-19 test in 2020.⁵² More importantly, just two days after filing for bankruptcy, it received FDA EUA for the first over-the-counter at-home combination test for COVID-19 and Influenza A/B.⁵², ⁵³ Despite this valuable technology, the company cited the “protracted and expensive” EUA process as a driver of its bankruptcy.⁵³

The auction for Lucira’s assets was scheduled for April 2023.⁵⁴

C. A Battle of Bids: Pfizer vs. Pearsanta

The auction evolved into a contentious battle between Pearsanta and the global pharmaceutical giant Pfizer Inc.

Table 3: Comparison of Bids for Lucira Health Assets

| Bidder | Initial Bid | Subsequent/Final Bid | Key Components | Stated Rationale for Acceptance/Rejection |

| Pearsanta, Inc. (Aditxt) | $23.8 million | $35.9 million | Initial cash of $13.4M; later included ADTX stock. | Rejected due to concerns over Aditxt’s “financial capacity” and ability to close the deal. |

| Pfizer Inc. | $21.2 – $26 million | $36.4 million | Initial cash as low as $5M; final bid was all-cash. | Accepted due to “significantly superior financial capacity” and certainty of closing. |

| Sources: ⁸, ⁵⁵, ⁵⁶, ⁵⁷ |

Initially, Pearsanta’s bid was numerically higher than Pfizer’s.⁵⁵, ⁵⁶ As the auction progressed, Pearsanta increased its offer to a value of $35.9 million by including 500,000 shares of ADTX stock.⁷ However, Pfizer ultimately won with a last-minute, all-cash bid of $36.4 million.⁸, ⁵³

D. Scrutiny in the Courtroom

The core issue of the auction was not the bid number, but the bidder’s credibility. Lucira’s financial advisors and creditors consistently favored Pfizer. The reason, stated explicitly in court filings, was Pfizer’s:

**”significantly superior financial capacity”**⁹, ⁵⁸

This was a direct and public indictment of Aditxt’s financial standing. At the end of 2022, Aditxt had only $2.8 million in cash.⁵⁹ A bid of over $35 million was therefore not a credible attempt backed by existing resources. It was a highly speculative venture contingent on Aditxt’s ability to raise the full purchase price from the capital markets after winning.

The bankruptcy court and creditors recognized this immense risk. They understood that accepting Pearsanta’s bid meant gambling on a financially weak micro-cap company’s ability to execute a massive, dilutive financing round under a tight deadline. Aditxt acknowledged its defeat, confirming it was designated only as the backup bidder.⁴⁸, ⁶⁰

While Judge Walrath did not explicitly state Aditxt could not raise the funds, her actions serve as a powerful implicit judgment. By approving the sale to Pfizer based on its “ability to continue Lucira’s business and meet the court-scheduled closing date,” the court validated the creditors’ concerns.⁷ The bankruptcy proceeding became an unexpected and public forum for vetting Aditxt’s financial health. The verdict was damning.

V. Market Reality and Regulatory Framework

The dramatic decline in Aditxt’s stock price has not gone unnoticed. The company’s stock is subject to significant bearish sentiment, as evidenced by short interest data. Simultaneously, many investors express frustration with Nasdaq for allowing such a company to remain listed.

A. The Short Seller Thesis

Short interest measures the number of shares sold short by investors betting that a stock’s price will fall.⁶¹, ⁶² High short interest indicates a bearish market view.

In Aditxt’s case, the data indicates “meaningful short interest”.⁴⁵ Reports have shown short interest as high as 16% of basic shares outstanding.⁴⁵, ⁶³ A figure exceeding 10% is often considered a significant red flag.⁶² Further evidence of bearish sentiment includes:

- Off-Exchange Short Volume Ratio: Reported as high as 67.64%, suggesting a majority of off-exchange trading is driven by short sellers.⁶³

- Short Borrow Fee Rate: Reported at over 23%, a very high level that signifies strong demand to short the stock.⁶³

Short sellers are likely not betting against Aditxt’s underlying science. Rather, it is a calculated financial bet on the high probability of the company’s destructive financing cycle continuing. They recognize that each new offering places immense downward pressure on the stock price. Shorting ADTX is a trade on the inevitability of the dilution-and-reverse-split treadmill.

B. Navigating the Nasdaq Listing Rules

A common question is why Nasdaq permits a company like Aditxt to remain listed. The answer lies in the procedural, rather than merit-based, nature of the exchange’s listing requirements. As long as a company follows the rules for curing deficiencies, it can maintain its listing, regardless of its business performance.

The primary rule Aditxt has repeatedly violated is Nasdaq Listing Rule 5550(a)(2), the Minimum Bid Price Requirement. This rule mandates a closing bid price of at least $1.00 per share.⁴⁰, ⁴²

The process for handling a violation is procedural:

- Notification: After a stock closes below $1.00 for 30 consecutive business days, Nasdaq issues a non-compliance notice.⁴⁰

- Compliance Period: The company is granted a 180-day grace period to regain compliance.⁴⁰

- Regaining Compliance: The stock’s closing bid price must be at or above $1.00 for at least 10 consecutive business days.⁴⁰

- Extension: An additional 180-day period may be granted if the company meets other criteria.⁴⁰

- Delisting: If compliance is not regained, Nasdaq issues a delisting determination, which the company can appeal.⁴⁰

Aditxt’s primary tool for navigating this process has been the reverse stock split. This action mathematically increases the share price.⁶, ⁴² From Nasdaq’s perspective, this is an acceptable, rule-based method for curing a bid price deficiency.

Therefore, Nasdaq “allows this” because Aditxt is using the mechanisms provided within the rules to maintain its listing. The exchange’s mandate is to enforce its standards, not to make a qualitative judgment about a company’s business model.⁶⁴ These procedural rules, while intended to help struggling companies, can be exploited. In this context, the Nasdaq listing becomes a critical component of the dilution engine itself.

VI. Future Outlook and Investor Considerations

The historical analysis of Aditxt’s strategy strongly indicates a continuation of its established patterns. For investors, understanding the likely future trajectory is critical.

The company’s business model remains fundamentally dependent on external financing to cover its operational cash burn.⁶⁰ With negligible revenue and a history of multi-million-dollar losses, the need to raise capital is a structural certainty.³⁴, ³⁵ This points to a high probability of future dilutive offerings. As these offerings increase the share count and pressure the stock price, the company will likely again fall out of compliance with Nasdaq’s minimum bid price rule.⁴⁰

Consequently, investors should anticipate more reverse stock splits. These actions, while procedurally necessary, have historically been a precursor to further value destruction. The cycle of dilution, price collapse, and reverse splits is likely to persist as long as the core business fails to generate sustainable revenue.

From a regulatory perspective, Aditxt’s actions have remained within Nasdaq’s procedural bounds.⁶⁴ Investors should not interpret a continued Nasdaq listing as an endorsement of the company’s financial health. The company’s own SEC filings repeatedly warn of these risks. They state that there is substantial doubt about its ability to continue as a “going concern”.⁶⁵

VII. Conclusion: A Model Structurally Misaligned with Shareholder Interests

The trajectory of Aditxt, Inc. is not the story of a promising biotechnology company facing typical hurdles. It is a case study of a corporate entity whose primary function has been to convert shareholder capital into operational losses and failed strategic maneuvers.

The company’s “innovation platform” model is predicated on acquiring disparate, pre-revenue assets. This unfocused approach, driven by a leadership team with a background in financial transactions, has ensured that no single program receives the funding necessary to achieve a meaningful milestone.

This flawed strategy is enabled by a financial structure that can only be described as a “dilution engine.” With virtually no commercial revenue, Aditxt’s survival has depended on raising over $100 million from capital markets. This has been achieved through a relentless cycle of dilutive offerings that destroy shareholder value, leading to a stock price collapse of over 99%. The repeated use of reverse stock splits is not a tool for recovery but a procedural necessity to reset the share price, maintain a Nasdaq listing, and begin the destructive cycle anew.

The 2023 attempt to acquire Lucira Health was the story’s climax. The bankruptcy court proceedings served as a public forum where Aditxt’s financial weakness was laid bare. The preference for Pfizer’s bid, based explicitly on concerns about Aditxt’s “financial capacity,” was a powerful, third-party indictment of the company’s standing.

The pattern of behavior is consistent with a business model that is structurally misaligned with the interests of its long-term public shareholders. The “craziness” of the cycle is the logical, albeit destructive, consequence of a company that has mastered the mechanics of accessing public capital but has utterly failed at the business of creating fundamental value. The rules of the Nasdaq exchange, while neutral, have inadvertently provided the framework that allows this cycle of value destruction to persist.

Works Cited

- Aditxt, Inc. “Homepage.” aditxt.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 424B3: Prospectus.” U.S. Securities and Exchange Commission. October 4, 2024.

- Market Chameleon. “ADTX Cash Flow Statement.” marketchameleon.com. Accessed October 21, 2025.

- The Options Clearing Corporation. “Aditxt, Inc. – Reverse Split.” infomemo.theocc.com. September 13, 2022.

- Moomoo News. “Aditxt To Carry Out 1-for-40 Reverse Stock Split On October 2nd, 2024.” moomoo.com. September 30, 2024.

- Business Wire. “Aditxt, Inc. (NASDAQ: ADTX) Announces 1-for-250 Reverse Stock Split.” businesswire.com. March 12, 2025.

- FirstWord HealthTech. “Pfizer boosts bid to win bankrupt Covid-flu test maker Lucira.” ml.firstwordhealthtech.com. April 16, 2023.

- InKnowVation. “Pfizer Buys Lucira Health for $36.4M Through Bankruptcy Auction.” inknowvation.com. April 28, 2023.

- Billion Law. “Billion Law Successfully Reopens Auction in Lucira Health Bankruptcy Case.” billionlaw.com. Accessed October 21, 2025.

- Aditxt, Inc. “Aditxt, Inc. is a social innovation platform…” markets.ft.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 424B4: Prospectus.” U.S. Securities and Exchange Commission. June 30, 2020.

- Aditxt, Inc. “Form S-1/A: Registration Statement.” U.S. Securities and Exchange Commission. June 5, 2020.

- Aditxt, Inc. “What We Do.” aditxt.com. Accessed October 21, 2025.

- Simply Wall St. “Aditxt, Inc. (NasdaqCM:ADTX) Company Profile.” simplywall.st. Accessed October 21, 2025.

- Aditxt, Inc. “Form 8-K: Current Report.” U.S. Securities and Exchange Commission. July 7, 2021.

- Aditxt, Inc. “Leadership.” aditxt.com. Accessed October 21, 2025.

- Fast Company Executive Board. “Amro Albanna | CEO – Aditxt.” board.fastcompany.com. Accessed October 21, 2025.

- Mendler, Adam. “Finish What You Started: Interview with Amro Albanna, Co-Founder and CEO of Aditxt.” adammendler.com. December 6, 2023.

- GuruFocus. “Amro A. Albanna Insider Trades.” gurufocus.com. Accessed October 21, 2025.

- ResearchGate. “Shahrokh SHABAHANG | Loma Linda University.” researchgate.net. Accessed October 21, 2025.

- Shabahang, Shahrokh. “State of the art and science of endodontics.” PubMed. January 2005.

- Alleva, David G., et al. “Reversal of Hyperglycemia and Suppression of Type 1 Diabetes in the NOD Mouse with Apoptotic DNA Immunotherapy™ (ADi™), ADi-100.” SciProfiles. March 12, 2020.

- Aditxt, Inc. “Form S-1/A: Registration Statement.” U.S. Securities and Exchange Commission. September 16, 2022.

- Aditxt, Inc. “Board of Directors.” aditxt.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 10-K/A: Annual Report.” U.S. Securities and Exchange Commission. April 28, 2023.

- Aditxt, Inc. “Annual Meeting Business Update.” aditxt.com. July 2022.

- Business Wire. “Aditxt Forms its Second Subsidiary, Pearsanta, Inc.” businesswire.com. February 14, 2023.

- BioSpace. “Aditxt Subsidiary Pearsanta Completes the Acquisition of Proprietary Adductomics Technology.” biospace.com. March 24, 2025.

- RedChip. “Aditxt Inc. (NASDAQ: ADTX) Stock Information.” redchip.com. Accessed October 21, 2025.

- BioSpace. “Aditxt’s Acquisition Target Appili Therapeutics Will Hold a Special Meeting of Shareholders.” biospace.com. October 10, 2024.

- Business Wire. “Appili President and CEO Don Cilla Will Join Aditxt Co-founder and CEO Amro Albanna at the Aditxt Weekly Update.” businesswire.com. April 2, 2025.

- Investing.com. “Evofem shareholders reject merger with Aditxt, company pivots to seek listing.” investing.com. October 21, 2025.

- PR Newswire. “Evofem Announces Voting Results from Special Meeting of Stockholders.” prnewswire.com. October 20, 2025.

- Financial Times. “Aditxt Inc (ADTX:NAQ).” markets.ft.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 10-Q: Quarterly Report.” U.S. Securities and Exchange Commission. November 14, 2023.

- Market Chameleon. “ADTX Cash Flow Statement.” marketchameleon.com. Accessed October 21, 2025.

- Quartz. “Aditxt Inc. (ADTX) Quarterly 10-Q Report.” qz.com. November 18, 2024.

- Aditxt, Inc. “Form S-1: Registration Statement.” U.S. Securities and Exchange Commission. June 26, 2023.

- Tiger Brokers. “ADiTx Therapeutics(ADTX) Filings.” itiger.com. Accessed October 21, 2025.

- Investing.com. “Aditxt faces Nasdaq delisting over share price rule.” investing.com. October 4, 2024.

- Moomoo News. “Aditxt To Carry Out 1-for-250 Reverse Stock Split.” moomoo.com. March 13, 2025.

- StockInsights.ai. “ADTX ADITXT INC Capital Structure Changes 8-K Filing.” stockinsights.ai. March 12, 2025.

- Tiger Brokers. “ADiTx Therapeutics(ADTX) Company Profile.” itiger.com. Accessed October 21, 2025.

- MacroTrends. “Aditxt – 5 Year Stock Price History | ADTX.” macrotrends.net. Accessed October 21, 2025.

- Trefis. “Aditxt, Inc. (ADTX) Stock Analysis.” trefis.com. Accessed October 21, 2025.

- Nasdaq. “Aditxt, Inc.’ s Wholly-Owned Subsidiary Pearsanta, Inc. Looks to Expand Customer Base.” nasdaq.com. June 28, 2023.

- Moomoo News. “Aditxt’s Pearsanta Unit Selected as Backup Bidder to Acquire Lucira Health’s Assets.” moomoo.com. April 17, 2023.

- Angeion Group. “Lucira Health, Inc. Bankruptcy Information.” bankruptcy.angeiongroup.com. Accessed October 21, 2025.

- Business Bankruptcies. “Lucira Health, Inc.” businessbankruptcies.com. Accessed October 21, 2025.

- Inforuptcy. “Case number: 1:23-bk-10242 – Lucira Health, Inc.” inforuptcy.com. Accessed October 21, 2025.

- Donlin Recano. “IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE.” donlinrecano.com. June 20, 2023.

- LabMedica International. “Pfizer Acquires COVID-Flu Test Developer Lucira Health for USD 36.4 Million.” labmedica.com. May 2, 2023.

- LabMedica International. “Pfizer Acquires COVID-Flu Test Developer Lucira Health for USD 36.4 Million.” labmedica.com. May 2, 2023.

- Angeion Group. “Lucira Health, Inc. Bankruptcy Information.” bankruptcy.angeiongroup.com. Accessed October 21, 2025.

- Billion Law. “Pfizer’s offer for Lucira challenged by backup bidder.” billionlaw.com. Accessed October 21, 2025.

- Billion Law. “Billion Law Successfully Reopens Auction in Lucira Health Bankruptcy Case.” billionlaw.com. Accessed October 21, 2025.

- FirstWord HealthTech. “Pfizer boosts bid to win bankrupt Covid-flu test maker Lucira.” ml.firstwordhealthtech.com. April 16, 2023.

- Billion Law. “Billion Law Successfully Reopens Auction in Lucira Health Bankruptcy Case.” billionlaw.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 10-K: Annual Report.” U.S. Securities and Exchange Commission. April 17, 2023.

- Aditxt, Inc. “Aditxt Issues Shareholder Update.” U.S. Securities and Exchange Commission. April 17, 2023.

- WallStreetPrep. “What is Short Interest?” wallstreetprep.com. Accessed October 21, 2025.

- Fidelity. “Using open and short interest to trade options.” fidelity.com. Accessed October 21, 2025.

- Fintel. “ADTX / Aditxt, Inc. – Short Interest.” fintel.io. Accessed October 21, 2025.

- Baker McKenzie. “Principal listing and maintenance requirements and procedures.” resourcehub.bakermckenzie.com. Accessed October 21, 2025.

- Aditxt, Inc. “Form 10-K: Annual Report.” U.S. Securities and Exchange Commission. March 25, 2021.

Leave a Reply

You must be logged in to post a comment.